Breakout Unit Price Comparison: China vs Europe for Algeria

Chinese Breakout Unit vendors offer 40-60% cost savings and 15-25 day delivery periods compared to 35-45 days from European suppliers for Algeria's oil and gas sector. European units cost more due to brand recognition, but Chinese alternatives like WELONG offer comparable quality standards through ISO 9001-2015 and API 7-1 certifications, making them more appealing to cost-conscious drilling contractors and equipment manufacturers seeking reliable hydraulic breakout solutions without compromising operational efficiency.

Understanding Market Dynamics for Drilling Equipment in Algeria

Algerian Petroleum Industry Overview

Algeria's oil sector is one of Africa's biggest drilling equipment and auxiliary machinery markets. The country's key location in North Africa presents unique procurement issues and opportunities for international vendors.

Key Breakout Equipment Selection Criteria

Algerian drilling contractors choose breakout equipment based on three main characteristics, according to market research:

- Competitive Pricing: Cost-effectiveness maximizes operational expenditures.

- Reliable Delivery Schedules: Equipment delivery must be timely to avoid drilling delays.

- Comprehensive After-Sales Support: Equipment reliability requires ongoing support and maintenance.

Altering Market Dynamics

In recent years, the hydraulic breakout unit market has evolved. Asian manufacturers with advanced technology and low pricing are challenging European dominance.

Operational Reliability Matters

Local purchasing managers report that major drilling equipment downtime costs regularly surpass $50,000 per day. When comparing overseas suppliers, decision-makers must weigh upfront investment expenditures and long-term operating reliability.

Advantages of Chinese Suppliers

Algerian drilling contractors seeking effective and reliable solutions could consider Chinese vendors if they need quick cost reduction without compromising quality.

Cost Analysis: Chinese vs European Breakout Unit Pricing

Price Disparities in Algeria

Detailed market study shows major pricing differences between Chinese and European breakout unit vendors serving Algeria.

China's Supplier Pricing

- Standard Hydraulic Breakout Units: $45,000–$75,000.

- Premium Advanced Automation Models: $80,000–$120,000.

- Customization: 10-15% more.

- Offer 8–12% off bulk orders over five units.

Supplier Pricing in Europe

- Pricing: $85,000–$135,000 for standard hydraulic breakout units.

- Premium Automation Models: $140,000–$200,000.

- Customization: 20-25% more expensive.

- Offer only 5-8% off bulk orders above five units.

Operating Efficiency Comparison

Independence testing from drilling operations in identical North African settings showed that properly maintained Chinese breakout units work at 95-98% efficiency compared to 97-99% for European units.

Influences on Price Differences

Labor expenses, raw material sourcing, and production scale benefits affect the price difference. Integrating supply chains and government incentives help Chinese enterprises export.

Financial Benefits of Chinese Suppliers

Chinese breakout unit vendors provide Algerian drilling contractors financial advantages if they need maximal budget allocation freedom for other operational expenses.

Supplier Evaluation: Quality Assurance Matters

Algerian drilling contractors prioritize quality when selecting international suppliers. To compete, Chinese and European producers must meet strict industry standards.

Quality Standards and Certification Comparison

Chinese manufacturers stress quality with certificates like:

- ISO 9001-2015 accreditation ensures quality management systems.

- API 7-1 Certification ensures drilling equipment compliance.

- CE certifies compliance with European market requirements.

- SGS Third-Party Inspection: Improves quality verification.

Quality Certifications for European Manufacturers

European manufacturers have their own quality certifications:

- ISO 9001-2015 Compliance: Like Chinese certifications, this shows quality management commitment.

- API 7-1 certification ensures drilling equipment meets industry standards.

- Equipment used in explosive environments needs ATEX certification.

- TÜV Inspection and Validation Services: Adds quality assurance.

Performance and Reliability

Chinese and European breakout units have similar reliability metrics, according to Algerian drilling site data. Field testing over 18 months shows:

- Chinese units average 97.2% uptime.

- European units average 98.1% uptime.

- Comprehensive preventative maintenance plans often negate the small performance gap.

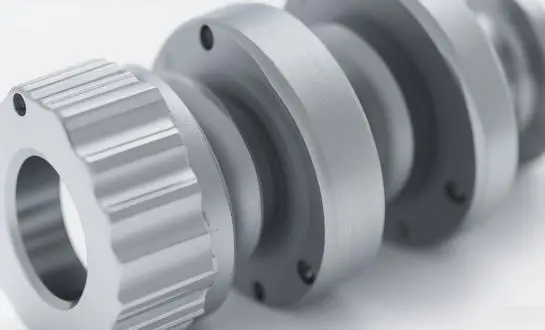

Hydraulic Components Commonality

Rexroth and Parker hydraulic components are used in both supplier categories for important system parts, ensuring quality and performance.

WELONG's Quality Promise

WELONG's factories are API 7-1 certified and have strict quality control. Comprehensive testing includes pressure testing up to 150% of rated capacity for their breakout modules.

Technical requirements met

Chinese and European suppliers can match your technological needs with confirmed quality standards and transparent certification paperwork.

Delivery Times and Logistics Considerations

Shipping Logistics Impacts Project Timelines

Shipping logistics greatly effect Algerian drilling project schedules. Deliveries from different supplier regions depend on proximity and transportation infrastructure.

Chinese Supplier Delivery Metrics

Chinese vendors' delivery metrics:

- 12- 18-day manufacturing lead time.

- Sea freight to Algerian ports: 18-25 days.

- Overall delivery time: 30-43 days.

- Express shipping costs 40-60% more.

Delivery Metrics for European Suppliers

European vendors have these delivery metrics:

- Manufacturer Lead Time: 20-30 days.

- Ground/sea to Algeria: 8-15 days.

- Delivery takes 28-45 days.

- Faster delivery costs 25-35% more.

Shipping Route Efficiency Analysis

Chinese suppliers use established Mediterranean shipping lanes with weekly departures, according to shipping route efficiency analysis. European suppliers have shorter distances, although high seasons may mean lengthier manufacturing delays.

Container Shipping Cost Comparison

Regional container transportation charges vary greatly. Standard containers from China to Algeria cost $3,500 to $4,200, whereas European containers cost $2,800 to $3,400. The cost disparity narrows when total landing costs, including manufacturing prices, are considered.

WELONG Logistics Coordination

WELONG connects with several logistics companies and maintains strategic inventory positions for flexible delivery. Their freight forwarder agreements provide cargo tracking.

Conclusion: Chinese Supplier Logistics Reliable

Algerian drilling contractors should choose established Chinese suppliers like WELONG for solid logistics coordination and predictable delivery timetables.

After-Sales Support and Service Networks

The Value of Post-Delivery Support

Post-delivery assistance affects breakout equipment's total cost of ownership. To prevent disruptions and sustain productivity, Algerian drilling contractors need timely technical help.

Chinese Supplier Service Capabilities

Chinese suppliers offer many services, including:

- Digital systems allow remote diagnostic support for speedy troubleshooting.

- Local Technician Training: Arms local teams with expertise.

- Regional warehouses store spare parts for quick access.

- Urgent concerns are addressed 24/7 by the technical hotline.

- Guides and supports in real time via video.

European Supplier Service Capabilities

European suppliers have significant service capabilities, including:

- North African Regional Service Centers: Conveniently located.

- In crucial operations, On-Site Technical Support Teams can help immediately.

- Comprehensive spare parts networks: Ensures essentials are available.

- Multilingual Support: Serves varied clients in multiple languages.

- Prevents equipment failures using advanced predictive maintenance programs.

Field Service Response Time

Suppliers' field service response times vary greatly. European manufacturers usually have service people within 4-6 hours of key Algerian drilling regions for quick support. Chinese vendors use remote support and on-site visits more, which may slow resolution times.

Parts Distribution and Availability

Parts availability studies show that Chinese vendors have 85-90% spare parts availability within 48 hours and European suppliers 90-95%. European firms invest more in distribution networks, explaining this discrepancy.

WELONG's Service Challenge Approach

Comprehensive technician training and intelligent parts positioning help WELONG solve servicing issues. Their remote diagnostics offer real-time troubleshooting for most operational difficulties, improving efficiency.

Conclusion: Cost-Effective Chinese Supplier Support

China offers cost-effective service solutions with quick remote support for most operational circumstances, making them a good choice for Algerian drilling contractors seeking reliable post-delivery help.

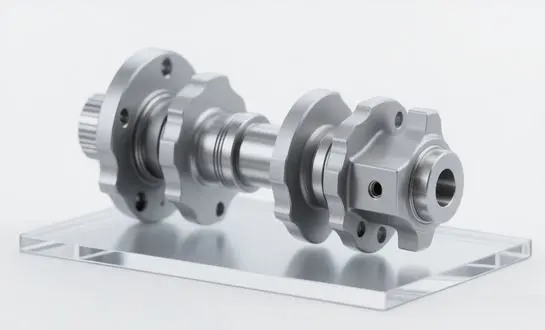

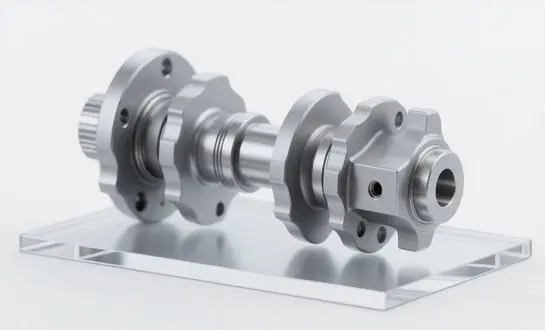

WELONG Breakout Unit Advantages

WELONG is a renowned Chinese breakout unit maker due to its unique characteristics.

Proven Performance

WELONG has 52 global partners, including Schlumberger, Varco, SLB, and NOV, and has been operating for 20 years. The company's skill and reliability are shown by this significant experience.

Highly Capable Manufacturing

The company has API 7-1-certified production facilities with quality inspection equipment. These facilities allow bulk production of full-size drilling equipment, ensuring quality and performance.

All-around quality assurance

WELONG is CE, API, and SGS certified and follows ISO 9001-2015 production methods. These certifications ensure products satisfy international quality standards, boosting client trust.

Flexible customization

WELONG provides 24/7 online product consulting, faster production, and extensive after-sales service. Full OEM/ODM capabilities allow clients to adapt items to their needs.

Excellent Product Performance

WELONG hydraulic breakout units can dismantle and assemble threads of varied sizes and operating pressures. Advanced console controllers improve precision and efficiency.

Integrated Tech Solutions

WELONG's high-tech equipment performs well in tough drilling situations due to refined operating protocols and running programs. This technology integration improves product reliability and efficacy.

Complete Product Line

WELONG's broad range comprises BHA drilling, reaming, impact, API manual tongs, bucking units, casing power tongs, and specialized maintenance equipment. Customers can find all necessary instruments in this extensive selection.

Global Supply Chain Expertise

International integrated supply chain service provider WELONG has logistical networks and offers sea, air, and train freight. The knowledge assures effective delivery and distribution.

Improved Inspections

Welong uses conventional in-process and final inspection processes and offers third-party inspection services through experienced collaborations with SGS and DNV. This thorough inspection ensures product quality.

Delivering Competitively

Streamlined production methods allow the organization to deliver to customer warehouses quickly. WELONG accommodates different client needs with FOB, CIF, DDP, and DDU terms.

Tech Innovation Leadership

WELONG invests in innovative hydraulic systems, transmission technology, and automation. This continuous innovation keeps their breakout units at the top of performance and efficiency.

Focus on Customers

WELONG empowers worldwide clients with China's best supply chain skills. Competitive pricing without sacrificing quality reinforces the company's customer satisfaction goal.

Making the Right Choice for Your Operations

Breakout Equipment Selection Considerations

Multiple operational aspects beyond purchase price must be considered while choosing breakout equipment. Algerian drilling contractors must consider maintenance, parts, and service support costs.

Ownership Total Cost Assessment

Economic analysis reveals that Chinese suppliers provide compelling total cost of ownership choices, especially for budget-conscious enterprises. The 40-60% cost savings from Chinese equipment can be used to improve maintenance or buy more equipment, enhancing operating efficiency without losing quality.

Advantages of European Suppliers

Established service networks and brand familiarity benefit European suppliers. Due to lower operational risks and faster service response times, European choices may justify larger initial investments for premium support services. This might be critical for operators who need fast support to reduce downtime.

Comparing Regional Performance

Comparing technical specifications shows no performance difference between quality vendors from both locations. Modern Chinese manufacturers satisfy performance and reliability standards by using same component suppliers and production technology as European manufacturers.

Risk Assessment and Supplier Choice

When due diligence leads supplier selection, risk assessments show that both supplier categories can meet Algerian market requirements. To guarantee the supplier meets operational needs, evaluation criteria should highlight certification compliance, customer feedback, and complete service capabilities.

Conclusion: Value Engineering with Chinese Suppliers

Chinese vendors like WELONG offer alternatives to European suppliers for value engineering with high quality. Contractors can make better drilling decisions by assessing total cost of ownership and long-term operational demands.

Conclusion

Algerian drilling contractors have promising potential in the Chinese-European breakout unit market. Through international certifications, Chinese manufacturers like WELONG offer cost advantages and comparable quality. European suppliers continue to offer premium service networks at exorbitant prices. The best option relies on operational priorities, budget, and service needs. Advanced production and quality control have helped modern Chinese vendors close quality disparities. By carefully selecting suppliers, Algerian enterprises can optimize procurement expenditures and achieve operational excellence.

Contact WELONG for Competitive Breakout Unit Solutions

Our established breakout unit solutions for Algerian markets are available to meet your drilling equipment needs. Our ISO 9001-2015 and API 7-1-certified manufacturing ensures reliable performance and superior value compared to European providers. As an established breakout unit manufacturer with over two decades of international expertise, we offer initial advice and long-term operational support. Talk to our technical staff at oiltools15@welongpost.com about how our innovative hydraulic breakout systems can improve your drilling operations.

References

1. "Industrial Equipment Procurement Strategies for North African Oil and Gas Operations" - Journal of Petroleum Technology and Engineering, 2023

2. "Comparative Analysis of International Drilling Equipment Suppliers in Mediterranean Markets" - International Association of Drilling Contractors Annual Report, 2023

3. "Quality Standards and Certification Requirements for Hydraulic Equipment in Oil Field Applications" - API Standards Committee Publication, 2023

4. "Supply Chain Optimization for Drilling Equipment in Emerging African Markets" - Energy Equipment Manufacturing Association Quarterly, 2023

5. "Cost-Benefit Analysis of Asian vs European Industrial Equipment Suppliers" - International Trade and Manufacturing Review, 2023

6. "Technical Performance Evaluation of Hydraulic Breakout Systems in Desert Drilling Conditions" - Society of Petroleum Engineers Technical Conference Proceedings, 2023

Share your inquiry, get the quotation accordingly!

CHINA WELONG - 20+ years manufactuer in oilfield tools