Key Factors Driving Drill Pipe Costs

Understanding the underlying factors influencing drill pipe prices is crucial for buyers looking to make informed decisions in 2025. Several key elements are shaping the cost landscape:

Raw Material Fluctuations

The cost of raw materials is a fundamental driver of drill pipe pricing, as steel and specialized alloys account for the majority of manufacturing expenses. Over recent years, global steel markets have experienced significant volatility due to supply chain disruptions, fluctuating production outputs, and increasing demand from construction, automotive, and energy sectors.

These fluctuations are further influenced by factors such as mining limitations, export restrictions, and currency exchange rate variations. For drill pipe manufacturers, even minor increases in raw material prices can directly translate to higher production costs. Consequently, buyers need to stay informed about trends in global steel and alloy markets, understand supplier pricing strategies, and consider the potential impacts of raw material scarcity. Proactive monitoring enables purchasing teams to anticipate cost changes, negotiate effectively with suppliers, and strategically plan procurement to maintain budget predictability and operational efficiency.

Energy Transition Impact

The ongoing global transition to cleaner and more sustainable energy sources is reshaping the oil and gas industry, influencing drill pipe requirements and costs. Modern exploration increasingly involves extreme environments, such as ultra-deepwater wells, high-pressure formations, and high-temperature reservoirs, which demand more advanced and durable drill pipe designs. Developing these specialized products requires substantial investment in research, engineering, and testing, all of which are reflected in the final price.

Additionally, regulations promoting environmentally responsible operations encourage manufacturers to adopt materials and processes that may further increase production costs. For buyers, this means understanding the relationship between enhanced drill pipe performance, operational safety, and overall cost. Investing in higher-grade, specialized drill pipes can improve well productivity and longevity, even if the upfront expenditure is greater, thereby balancing performance and economic considerations in evolving energy markets.

Geopolitical Influences

Global geopolitical conditions are a persistent factor affecting drill pipe prices and availability. Trade policies, tariffs, regional conflicts, and sanctions can disrupt supply chains, delay shipments, and create sudden price volatility. For instance, restrictions on steel exports or sanctions against key manufacturing regions may reduce material availability, driving up costs.

Furthermore, political instability in resource-rich regions can affect production timelines and increase logistical expenses. Buyers must consider these geopolitical risks when planning procurement, as unexpected disruptions can impact project schedules and budgets. Strategies such as diversifying supplier networks, maintaining safety stock, and establishing long-term contracts with reliable vendors are essential to mitigate these risks. A comprehensive understanding of geopolitical dynamics allows buyers to anticipate potential market shocks, make informed purchasing decisions, and maintain operational continuity in an unpredictable global environment.

Emerging Technologies Impacting Pricing

The integration of cutting-edge technologies into drill pipe manufacturing and utilization is reshaping the industry landscape and influencing pricing dynamics:

Smart Drill Pipe Systems

Advancements in sensor technology and data analytics have led to the development of smart drill pipe systems. These innovative solutions offer real-time monitoring of drilling parameters, enhancing operational efficiency and reducing downtime. While the initial investment in such technology may be higher, the long-term benefits in terms of performance and cost savings are becoming increasingly apparent to buyers.

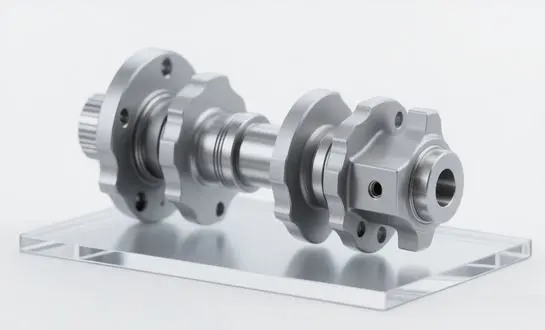

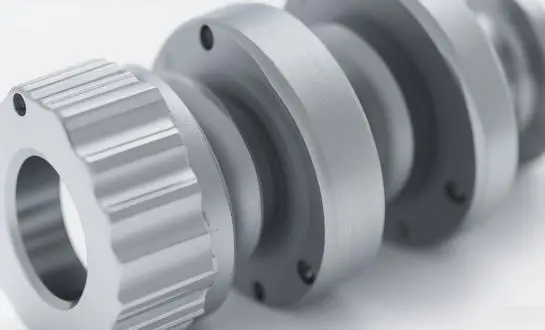

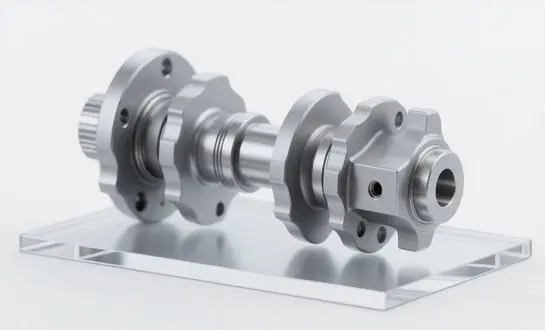

Additive Manufacturing

3D printing technologies are making inroads into drill pipe production, enabling the creation of complex geometries and customized designs. This manufacturing approach has the potential to reduce material waste and production time, potentially leading to more competitive pricing for specialized drill pipe components. Buyers should consider the long-term cost benefits of these technologically advanced products when making procurement decisions.

Nanotechnology Applications

The application of nanotechnology in drill pipe coatings and materials is enhancing wear resistance and extending operational lifespans. These advancements, while potentially increasing upfront costs, offer significant value in terms of reduced maintenance and replacement frequencies. Buyers should evaluate the total cost of ownership when considering these high-performance drill pipe options.

Strategies for Cost-Effective Procurement

In light of the evolving drill pipe market conditions, buyers can implement several strategies to optimize their procurement processes and manage costs effectively:

Long-Term Partnerships

Establishing strategic relationships with reliable drill pipe suppliers can lead to more favorable pricing terms and priority access to inventory. These partnerships often involve volume commitments but can provide stability in pricing and supply chain management. Buyers should seek out suppliers with a proven track record of quality and innovation in the drill pipe sector.

Life Cycle Cost Analysis

When evaluating drill pipe options, it's essential to consider the total cost of ownership rather than focusing solely on the initial purchase price. Factors such as durability, maintenance requirements, and operational efficiency should be factored into the decision-making process. This holistic approach can lead to more cost-effective procurement in the long run.

Inventory Optimization

Implementing advanced inventory management systems can help buyers strike a balance between maintaining adequate drill pipe stock levels and minimizing carrying costs. Just-in-time delivery arrangements with suppliers can reduce storage expenses while ensuring operational continuity. Buyers should leverage data analytics to forecast demand accurately and optimize their inventory strategies.

Alternative Sourcing Models

Exploring alternative sourcing models, such as leasing or pay-per-use arrangements for drill pipe, can provide flexibility and potentially reduce capital expenditure. These models may be particularly beneficial for projects with uncertain durations or fluctuating demand. Buyers should carefully evaluate the terms of such arrangements to ensure they align with their operational needs and financial objectives.

Conclusion

In conclusion, the drill pipe market in 2025 presents both challenges and opportunities for buyers. By staying informed about market trends, embracing technological innovations, and implementing strategic procurement practices, buyers can navigate the complexities of the industry and make cost-effective decisions. As the energy landscape continues to evolve, adaptability and foresight will be key to success in drill pipe procurement.

For more information on high-quality drill pipe solutions and expert guidance on procurement strategies, please contact us at oiltools15@welongpost.com. Welong is committed to providing innovative and reliable drill pipe products to meet the evolving needs of the oil and gas industry.

References

1. The Business Research Company (2025). Drill Pipe Market Report 2025 – Market Size and Trends, including forecast growth from USD 1.5 billion in 2024 to USD 1.56 billion in 2025, with a CAGR of 3.8% in the historic period and 5.8% over the next few years.

2. Global Market Insights (2024–2025). Drill Pipe Market Size 2025-2034 Global Trends Report, forecasting the global drill pipe market value at USD 2 billion in 2024 and projecting a CAGR of over 7.1% from 2025 to 2034.

3. Business Research Company (2025). Drill Pipe Market Insights 2025: Comprehensive Overview & Emerging Opportunities, showing market expansion from USD 1.5 billion in 2024 to USD 1.58 billion in 2025 with a CAGR of 5.4%, and forecast to reach USD 2.01 billion by 2029.

4. Research and Markets (2025). Drill Pipe Market Report 2025, reporting a market value of USD 1.58 billion in 2025, growth from USD 1.5 billion in 2024, with a CAGR of 3.8%, and projecting USD 1.95 billion by 2029.

5. MetaStat Insight (2025–2032). Drill Pipe Market Size & Share Analysis Report, estimating the global drill pipe market at USD 2,756.40 million in 2025, with a CAGR of 4.0% projected through 2032.

6. Grand View Research (2024–2030). Drill Pipe Market Size, Share, Trends Analysis Report, forecasting growth from approximately USD 2,305.08 million in 2024 to USD 2,895.21 million by 2030, at a CAGR of 3.9%.