Drilling Hose Price Guide for Middle East Projects

The Middle East's booming energy sector continues driving demand for high-quality drilling equipment. Regional projects require specialized oilfield drilling hose systems capable of withstanding extreme temperatures and pressures common in desert drilling environments. Smart procurement strategies can reduce costs by 15-30% while ensuring reliable supply chain performance. Market volatility affects pricing structures significantly. Raw material fluctuations, geopolitical tensions, and shipping disruptions impact overall project budgets. Successful drilling contractors understand these variables when planning equipment procurement for multi-year exploration campaigns across Saudi Arabia, UAE, Qatar, and Iraq. This comprehensive price guide addresses critical cost factors affecting oil and gas drilling operations across the region. Understanding market dynamics, supplier negotiations, and hidden expenses helps procurement teams secure competitive drilling hose solutions while maintaining operational efficiency and project timelines.

Current Market Price Analysis for Drilling Hose Systems

Factory Price Ranges and FOB Terms

Flexible drilling hose pricing varies considerably based on specifications and manufacturing quality standards. Standard 2-inch diameter units range $200-$400 FOB China ports, while premium high pressure drilling hose systems command $500-$800 per unit. Grade A drilling hoses typically cost 20% less than Grade D or E specifications.

CIF pricing to major Middle Eastern ports adds $50-$120 per unit depending on destination and shipping volumes. Dubai and Jeddah ports offer competitive freight rates, while smaller regional ports may increase logistics costs significantly. Container consolidation reduces per-unit shipping expenses for large orders.

Drilling hose assembly packages including couplings and fittings range $300-$1,200 complete units. Integrated systems provide better value proposition compared to purchasing components separately. Quality manufacturers offer comprehensive testing certificates ensuring compliance with API 7K standards.

Minimum Order Quantities and Volume Discounts

Most drilling hose manufacturer facilities require 50-unit minimum orders for standard specifications. Custom configurations may demand 100-200 piece minimums depending on complexity. Volume discounts typically begin at 100 units with 5-8% price reductions.

Orders exceeding 500 units qualify for 12-15% bulk discounts. Long-term supply agreements spanning multiple projects can secure additional 3-5% pricing advantages. Payment terms significantly impact final pricing, with 30% deposits enabling better manufacturer pricing flexibility.

Special engineering requirements increase minimum order thresholds. Reinforced drilling hose designs with unique pressure ratings or temperature specifications require larger production runs. Planning procurement cycles around these minimums optimizes cost efficiency for drilling contractors.

Critical Factors Influencing Drilling Hose Pricing

Raw Material Cost Dynamics

Synthetic rubber prices directly impact drilling fluid hose manufacturing costs. Natural rubber market fluctuations affect NBR and chloroprene rubber pricing by 10-25% annually. Steel wire reinforcement costs correlate with global steel pricing trends and metal commodity markets.

Oil price volatility creates upstream pressure on petroleum-based rubber compounds. High oil prices increase synthetic rubber production costs, subsequently raising drilling hose prices. Manufacturing facilities maintain 60-90 day raw material inventories, creating pricing lag effects during volatile periods.

Quality control requirements drive premium material selection. Abrasion resistant drilling hose designs require specialized rubber compounds costing 15-30% more than standard formulations. These investments pay dividends through extended service life and reduced replacement frequency.

Manufacturing and Labor Considerations

Skilled labor shortages in specialized rubber manufacturing affect production capacity and pricing. Experienced technicians capable of producing high pressure systems command premium wages. Training programs require 6-12 months developing competent drilling hose assembly workers.

Energy costs significantly impact manufacturing economics. Rubber curing processes require substantial electricity consumption, making energy-efficient facilities more competitive. Environmental compliance investments increase manufacturing overhead but ensure sustainable operations.

Quality management system maintenance requires ongoing investment in testing equipment and certification processes. ISO 9001 and API certifications demand regular audits and documentation, adding operational complexity but ensuring customer confidence in drilling hose durability.

Exchange Rate and Economic Factors

Currency fluctuations create pricing uncertainty for international drilling hose suppliers. Chinese Yuan appreciation against the US Dollar increases costs for American and European buyers. Hedging strategies help manufacturers stabilize pricing despite currency volatility.

Regional economic conditions affect demand patterns and pricing power. Economic growth in Gulf states drives drilling activity and equipment demand. Conversely, budget constraints during low oil price periods reduce project activity and pressure equipment pricing.

Trade policy changes impact supply chain costs and availability. Tariff modifications, export restrictions, and trade agreement updates require procurement teams to monitor regulatory developments affecting drilling hose sourcing strategies.

Optimization Strategies for Procurement Excellence

Effective Supplier Negotiation Approaches

Partners get perks and price advantages over time. Over short-term profit maximization, suppliers value predictable order volumes and payment reliability. Consistent communication and fairness improve price discussions. Technical specification optimization balances cost and performance. Over-specification wastes money and under-specification causes operational problems. Collaborative engineering studies find cost-effective performance configurations. Payment term agreements greatly affect price structures. Early payment gives suppliers financial benefits that save customers money. Letters of credit provide security and bargaining power.

OEM and customization strategies

Optimization of mud drilling hose specifications reduces expenses. Cost reduction is possible by removing unneeded features or performance margins. Partnering with engineering teams uncovers optimization potential that procurement methods miss. Private labeling boosts branding at low expense. Volume agreements allow suppliers to build dedicated manufacturing facilities. Quality consistency and lead times increase with these agreements. Technical cooperation on drilling hose safety benefits all parties. Suppliers learn product development while consumers improve performance. These partnerships frequently lead to industry-standard innovations.

Supply Chain Risk Management

Supplier diversity decreases reliance concerns and maintains competitive pricing. Multiple qualified suppliers avoid supply interruptions and provide bargaining options. Regular supplier capability evaluations maintain performance. Inventory management solutions balance carrying costs and supply security. Stock placing near key drilling areas lowers emergency procurement costs. Inventory on consignment may be available without funding. Quality assurance procedures prevent expensive field failures and accidents. Drilling hose parameters fulfill rigorous operating requirements thanks to thorough testing processes. Quality prevention costs far more than repair.

Future Market Trends and Price forecast

Technology affects pricing

Advanced manufacturing methods steadily lower prices and improve quality. Automation initiatives reduce labor costs and improve accuracy. These improvements usually take 3-5 years to affect market price. Materials science promises improved performance at reasonable prices. New polymers may be more abrasion-resistant or temperature-tolerant. Early adoption gives a competitive edge before market acceptance. Integration of digital supply chains lowers transaction costs and boosts efficiency. Electronic procurement solutions simplify ordering and improve pricing transparency. Efficiency gains lead to client savings over time.

Forecasts for market demand

Middle East drilling activity is expected to expand, sustaining equipment demand. In the short run, renewable energy investments support hydrocarbon exploration. Infrastructure development needs drilling equipment till 2030. Regulatory modifications focusing on drilling hose requirements may raise compliance costs but improve safety. Higher testing and certification standards increase costs but lower operational hazards. Geopolitical stability impacts long-term investment and planning. Regional cooperation efforts fund infrastructure development that requires large drilling equipment purchases. Contingency planning is needed for supply chain disruptions due to politics.

Economic indicators, price trends

Manufacturing costs are affected by inflation across all inputs. Increased labor, energy, and material costs usually affect equipment prices within 6-12 months. Long-term contracts may temporarily shield these demands. Global economic growth affects drilling equipment demand and cost. Economic growth boosts energy consumption and equipment investment. Recession worries may affect prices despite rising costs. Currency stability is essential for international procurement planning. Exchange rate fluctuation hampers budgeting and supplier relations. Financial hedging reduces risks but complicates procurement.

Conclusion

Middle East drilling hose procurement demands full grasp of cost, quality, and supply chain issues. Strategic supplier connections and specification optimization may optimize costs in the current market. Successful procurement teams manage supply chain risks and balance cost and performance. Future market trends include demand growth, steady supplier connections, and competitive pricing. Technology promises better performance and production efficiency may lower costs. Good procurement strategies stress long-term relationships, quality, and supply chain diversity. Smart procurement improves delivery dependability and product performance while saving 15-25%. These approaches involve supplier connections, technical knowledge, and market information yet provide significant returns during multi-year drilling campaigns.

Frequently Asked Questions

1. What variables most affect Middle East drilling hose pricing?

Pricing is driven by raw material prices, order quantity, and transportation. Base costs for synthetic rubber and steel wire vary with commodities markets. Above 100 units, volume savings are considerable, although shipping prices vary by port and delivery time. Quality standards can greatly affect cost. High-pressure drilling hoses with improved abrasion resistance cost more. API certification increases compliance expenses but ensures dependable performance in demanding applications.

2. How do minimum order numbers effect project costs?

Many respectable drilling hose manufacturers need 50-100 units for regular goods. Higher minimums for custom requirements may increase inventory investment. For active drilling operations, volume pricing offsets increased inventory carrying costs. Planning procurement cycles around these minimums maximizes cost efficiency and inventory availability. Supplier collaboration on manufacturing schedule may handle smaller orders.

3. How should procurement teams budget drilling hose purchases? What hidden costs?

Beyond FOB price, import tariffs, customs brokerage, and inland transportation are expensive. Depending on location and infrastructure, these costs average $50–120 per unit. Quality inspections reduce risk but cost $500–$2,000 every shipment. For long-term procurement operations, currency fluctuations may dramatically affect project costs. Financial hedges mitigate these risks but need skill and may increase transaction costs.

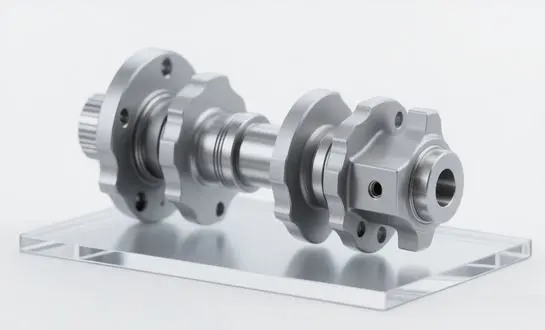

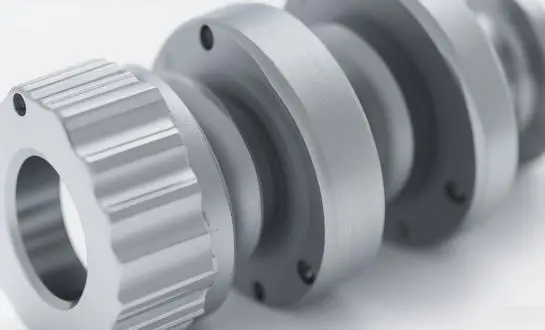

Make Your Drilling Hose Supply Chain Successful with WELONG

Through our supply chain knowledge and quality-focused approach, WELONG can change your drilling hose procurement experience. Our vast network of API-certified drilling hose supply partners provides superior oilfield drilling hose solutions for the most demanding Middle East projects. We have provided drilling contractors with affordable, high-performance drilling equipment while keeping high quality standards since 2001. Our ISO 9001:2015 accreditation proves our systematic quality control throughout procurement. Our technical staff offers experienced help on optimizing specifications for flexible drilling hose assemblies, high pressure systems, and mud drilling hose designs.

Streamlined procurement removes supply chain bottlenecks and provides clear pricing and consistent delivery dates. We believe drilling operations are vital and keep strategic inventory to respond quickly to urgent needs. Quality assurance programs test and record drilling hose assemblies to meet or exceed project requirements.

Contact our experienced procurement specialists at oiltools15@welongpost.com to discuss your drilling hose requirements and discover how WELONG can optimize your equipment supply chain performance while reducing total project costs.

References

- International Association of Drilling Contractors. "Global Drilling Equipment Market Analysis and Regional Demand Patterns." Annual Industry Report, 2024.

- American Petroleum Institute. "API Specification 7K: Drilling and Well Servicing Equipment Standards and Testing Protocols." Technical Publication, 2023.

- Middle East Petroleum Equipment Suppliers Association. "Regional Procurement Trends and Cost Analysis for Oilfield Equipment." Market Research Study, 2024.

- Society of Petroleum Engineers. "Drilling Fluid Systems and Equipment Performance Standards in High-Temperature Environments." Technical Conference Proceedings, 2023.

- Gulf States Industrial Development Council. "Supply Chain Optimization Strategies for Oil and Gas Equipment Procurement." Economic Development Report, 2024.

- International Energy Agency. "Middle East Energy Infrastructure Investment Outlook and Equipment Demand Projections." Strategic Analysis Report, 2024.

Share your inquiry, get the quotation accordingly!

CHINA WELONG - 20+ years manufactuer in oilfield tools