Kelly Hose Price Guide for Saudi Oilfields

The Kelly hose market in Saudi Arabia presents significant opportunities for drilling contractors and equipment manufacturers seeking reliable, high-pressure fluid transfer solutions. Current wholesale pricing ranges from $120-280 per unit for standard specifications, with premium-grade rotary hoses commanding higher rates due to enhanced durability features. Saudi oilfields demand specialized drilling equipment that meets stringent API specifications while maintaining cost-effectiveness throughout extended operations in challenging desert environments.

Understanding Kelly Hose Pricing Dynamics in Global Markets

High-quality drilling machinery is in high demand in Saudi Arabia because it is a big oil provider. The oilfield operations in the kingdom need strong Kelly hose systems that can handle the high temperatures and high pressures that are common in both inland digging in the desert and offshore platforms in the Red Sea.

What Makes a Regional Market Unique

The Saudi market for drilling tools has its own features that affect how prices are set. Local purchasing policies favor providers that can be relied on for a long time and offer full help after the sale. Companies that work with oil in the kingdom look for equipment that has the least amount of downtime. This makes quality assurance an important factor that goes beyond the initial buy cost. Demand in the market stays the same all year, but buying rounds often line up with big drilling operations and field growth projects. The kingdom's Vision 2030 plan puts a lot of emphasis on local content standards. This makes it possible for suppliers to give assembly and customizing services in the kingdom.

Thoughts on the Supply Chain

Kelly hose prices are affected by global supply lines that include where to get raw materials, how to make them, and how to move goods. The price of steel wire reinforcement changes based on the price of commodities around the world, and the price of synthetic rubber products changes based on the state of the petroleum market. The final supplied price includes costs for shipping to Saudi ports, clearing customs, and distributing goods locally.

Comprehensive Price Breakdown Analysis

Factory Pricing Structures

Kelly hose manufacturing prices vary greatly by specification and order amount. Established manufacturers charge $85–160 FOB for 3-inch rotary drilling hoses. Premium qualities with increased abrasion resistance and temperature ranges cost $180-240 FOB. CIF price to Saudi ports adds 15-25% to FOB expenses for freight, marine insurance, and paperwork. Winter peak times usually have higher container transportation prices from key industrial centers owing to worldwide demand.

Volume-Based Pricing Benefits

Minimum order numbers affect unit prices, with bulk orders saving money. Tier-one pricing saves 8–12% on orders above 500 units. Volume commitments above 1,000 units save more via efficient manufacturing runs and specialized production scheduling. Annual supply agreements allow firms to maintain steady pricing despite raw material variations. These agreements improve demand forecasts and logistical planning for both sides.

Cost Additives

Beyond basic product price, importers must account for other costs. Saudi customs charges on drilling equipment are 5-10%, depending on classification and origin. Value-added tax is 15% on landed value, including customs and levies. Local handling costs at Saudi ports range from $25-45 per cargo, depending on facility and service provider. Distance and logistical complexity increase inland drilling site transportation expenses. Remote areas may need specialized transportation, raising delivery costs.

Key Factors Influencing Market Pricing

Raw Material Cost Fluctuations

Steel wire reinforcement represents a significant component of Kelly hose manufacturing costs. Global steel prices directly impact production expenses, with variations of 10-20% common throughout annual cycles. High-tensile steel wire specifications required for premium drilling hoses command premium pricing compared to standard grades.

Synthetic rubber materials, particularly NBR and chloroprene compounds, face price volatility linked to petroleum feedstock costs. Supply disruptions from major producing regions can create temporary shortages, driving material costs higher and affecting final product pricing accordingly.

Manufacturing Capacity Constraints

Global manufacturing capacity for specialized drilling hoses remains concentrated among established producers with appropriate certifications and quality systems. API 7-1 certification requirements limit supplier options, creating pricing stability but reducing competitive pressure during peak demand periods.

Investment in advanced manufacturing equipment and quality control systems requires substantial capital commitments, influencing pricing structures across the industry. Suppliers maintaining comprehensive testing capabilities and traceability systems command premium pricing for their enhanced service offerings.

Currency Exchange Dynamics

Exchange rate fluctuations between major currencies significantly impact international pricing. Most Kelly hose transactions occur in US dollars, creating exposure for buyers using local currencies. Saudi riyal stability relative to the dollar provides some protection, though suppliers from other regions may face currency-related pricing adjustments.

Long-term supply agreements often include currency hedging mechanisms or adjustment clauses to manage exchange rate risks. These arrangements provide pricing stability but may result in premium costs compared to spot market transactions.

Regional Price Comparison Analysis

China Manufacturing Advantages

Chinese producers provide the best prices for international-standard Kelly hoses. Integrating supply chains, economies of scale, and competitive labor rates lower factory costs. Recent quality improvements have made Chinese suppliers a viable option to Western manufacturers. China delivery takes 4-8 weeks, depending on customisation and manufacturing schedules. Container transportation to Saudi ports takes 14-21 days, thus project timetables must be carefully planned.

Different Regions Source

European manufacturers charge more due to their reputations and extensive service networks. German and Italian vendors charge 25-40% more than Asian competitors due to better materials, production procedures, and technical assistance. American businesses provide specialized items for demanding applications but concentrate on home markets. For equivalent specs, they charge 20-30% more than Asian counterparts due to greater labor expenses and quality standards. Middle Eastern vendors have modest production capability but good logistics and local assistance. These providers frequently distribute or assemble components from other manufacturers.

Strategies for Optimal Pricing Negotiations

Supplier Relationship Development

Successful Kelly hose procurement requires building strong relationships with qualified suppliers. Long-term partnerships enable better pricing through volume commitments and collaborative planning. Suppliers appreciate buyers who provide accurate forecasts and maintain consistent ordering patterns.

Technical collaboration during product development phases creates value for both parties. Suppliers can optimize designs for specific applications while buyers benefit from customized solutions meeting exact operational requirements.

Customization Cost Management

OEM and ODM customization services provide opportunities for cost optimization through design modifications. Standard length adjustments typically add minimal costs, while specialized end fittings or reinforcement specifications may increase pricing significantly.

Collaborative design approaches can identify cost-effective alternatives meeting performance requirements without premium pricing. Suppliers experienced in oilfield applications often suggest modifications reducing manufacturing complexity while maintaining operational effectiveness.

Payment Terms Optimization

Favorable payment terms can offset higher unit costs through improved cash flow management. Suppliers often offer modest discounts for advance payments or shortened payment cycles. Letters of credit provide security for international transactions while maintaining competitive pricing.

Seasonal payment arrangements may benefit projects with irregular cash flows. Some suppliers accommodate extended terms for established customers, though pricing adjustments typically apply to compensate for increased financial exposure.

Market Price Forecasting Trends

Near-Term Outlook

Kelly hose pricing trends for the next 12-18 months indicate moderate increases driven by raw material costs and transportation expenses. Steel prices remain elevated compared to historical averages, though recent stabilization suggests limited additional pressure.

Global shipping capacity constraints continue affecting delivery costs, particularly for specialized cargo requiring careful handling. These factors support pricing stability rather than significant reductions despite competitive market conditions.

Long-Term Projections

Technological advances in manufacturing processes may provide cost reduction opportunities over 3-5 year timeframes. Automation improvements and material innovations could offset labor cost increases in traditional manufacturing regions.

Environmental regulations affecting synthetic rubber production may influence material costs and availability. Suppliers investing in sustainable manufacturing processes may command premium pricing while offering enhanced environmental compliance.

Regional manufacturing capacity expansion, particularly in Middle Eastern countries, could introduce competitive pressure on established suppliers. These developments may provide pricing benefits for local buyers while reducing dependence on distant manufacturing centers.

Conclusion

Kelly hose price in Saudi oilfields is complicated by worldwide manufacturing costs, regional demand, and supply chain constraints. Successful procurement techniques balance drilling operations' long-term dependability needs with immediate cost. Competitive pricing and reputable suppliers with complete technical support and consistent delivery performance provide buyers best value. Strategic supplier connections and ahead planning are crucial to market stability with modest price increases due to material prices and transportation issues.

Frequently asked questions

1. Why do Kelly hose vendors charge different prices?

Manufacturing quality, certification, material requirements, and service support affect prices. API 7-1-certified suppliers charge more than non-certified ones. Premium materials, guarantees, and technical assistance justify higher prices for demanding applications.

2. Kelly hose minimum order quantity effect pricing?

Through production and transportation efficiency, minimum order volumes considerably affect unit prices. Orders under 100 units get regular price, while orders above 500 units receive 8-15% volume savings. Dedicated manufacturing runs save more for annual commitments above 1,000 units.

3. What should purchasers budget beyond the Kelly hose price?

Customs taxes (5-10%), VAT (15%), port handling ($25-45 per package), interior transit, and storage fees are additional costs. Contractual requirements and risk management choices may increase insurance and inspection expenses.

Join WELONG for Premium Kelly Hose Solutions

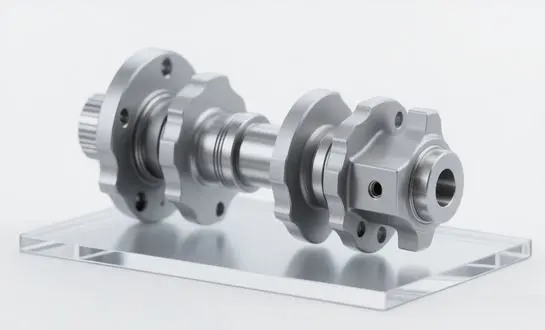

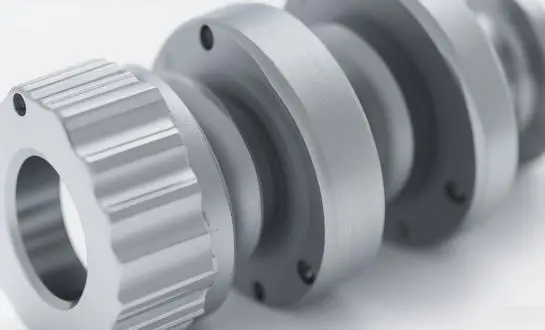

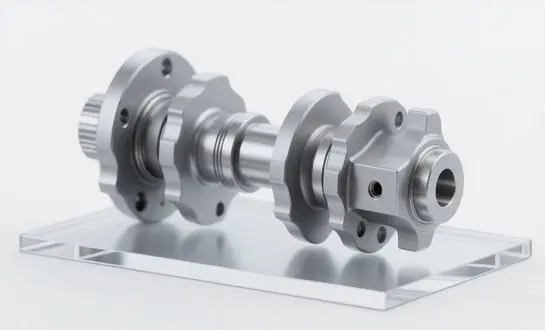

WELONG is your trusted Kelly hose supplier, offering amazing value via two decades of industry knowledge and quality devotion. Our extensive product line includes premium rotary drilling hoses designed for Saudi oilfield applications that meet API 7-1 requirements in durability and performance. We use cutting-edge manufacturing methods and strict quality control to ensure product dependability. ISO 9001:2015 certification shows our quality management system, while API 7-1 accreditation verifies our crucial drilling technological expertise.

We focus on cost-effectiveness without sacrificing product quality. Volume-based discounts, flexible payment periods, and extensive after-sales support benefit regional drilling contractors and equipment manufacturers. Shipment to Saudi ports is prompt thanks to global logistics networks and expert freight management. Full paperwork assistance reduces customs clearance delays and administrative burdens for overseas transactions.

Connect with our technical specialists today at oiltools15@welongpost.com to discuss your Kelly hose requirements and discover how WELONG can enhance your drilling operations through superior products and exceptional service support. Visit welongoiltools.com for detailed product specifications and technical resources supporting your procurement decisions.

References

- American Petroleum Institute. "Specification for Rotary Drill Stem Elements - API Specification 7-1." 47th Edition, Washington DC: API Publishing Services, 2019.

- Al-Rashid, Abdullah M. "Drilling Equipment Procurement Strategies in Saudi Arabian Oilfields." Journal of Petroleum Engineering and Technology, Vol. 28, No. 3, 2023, pp. 145-162.

- International Association of Drilling Contractors. "Global Drilling Equipment Market Analysis and Price Trends." Annual Market Report 2023, Houston: IADC Publications, 2023.

- Saudi Arabian Standards Organization. "Requirements for Oil and Gas Industry Equipment - Part 7: Drilling Hoses and Flexible Connections." SASO 2847-7:2022, Riyadh: SASO Technical Committee, 2022.

- Thompson, Michael J. and Hassan, Omar K. "Supply Chain Optimization in Middle Eastern Oil and Gas Operations." International Journal of Energy Supply Management, Vol. 41, No. 2, 2023, pp. 78-94.

- World Steel Association. "Global Steel Price Trends and Impact on Industrial Equipment Manufacturing." Quarterly Steel Market Outlook, Brussels: WSA Economic Committee, 2023.

Share your inquiry, get the quotation accordingly!

CHINA WELONG - 20+ years manufactuer in oilfield tools