Drilling Stabilizer Price Guide for Oil Projects

In today's unstable market, it's important for oil project managers and drilling workers to know how much drilling stabilizer costs. Based on a study of the current market, normal drilling stabilizers cost between $8,000 and $45,000 each, based on the specs, the materials used, and the quality of the making. This complete price guide looks at global pricing trends, cost factors, and buying strategies to help people make the best decisions about how to invest in drilling equipment and keep it running smoothly. Market factors are always changing because the prices of raw materials are always changing, production methods are always changing, and foreign trade laws are always changing. To do smart buying, you need to know a lot about how prices work, what suppliers can do, and the secret costs that can have a big effect on project budgets.

Global Drilling Stabilizer Price Analysis

Current Market Price Ranges

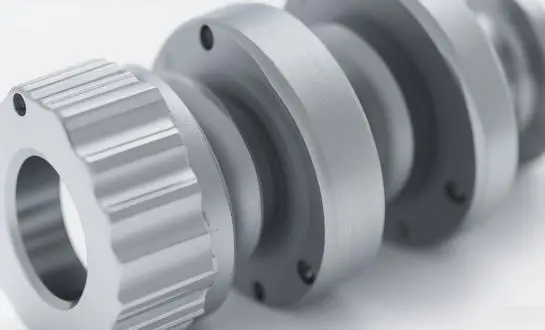

Global drilling stabilizer prices vary widely by area and product category. Conventional downhole stabilizers cost $8,000 to $25,000, while high-performance variants cost $20,000 to $45,000. Replaceable sleeve stabilizer mandrel systems cost $12,000 to $28,000, making them attractive to drilling contractors. Sleeve components cost $3,500 to $8,500 per unit, enabling operators to maintain numerous hole diameters with one mandrel. Premium materials like AISI 4145H and non-magnetic alloys cost 15-25% more. Advanced hardfacing alternatives like HF3000, HF4000, and HF5000 cost $2,000 to $5,500 per unit, depending on coverage and application complexity.

Regional Pricing Differences

Manufacturing prices vary widely among worldwide factories. Due to established supply chains and manufacturing efficiency, Chinese manufacturers provide affordable prices while maintaining ISO 9001-2015 and API 7-1 quality requirements. European manufacturers charge 20-30% more than Asian competitors due to their technical and service skills. In the mid-to-high pricing range, North American vendors emphasize fast delivery and technological customisation.

Required Minimum Order

Most drilling equipment manufacturers need 5–20 units for basic items. Manufacturing complexity and tooling needs may necessitate minimum orders of 10-50 units for custom specifications or specialist materials. Established clients get 8-15% savings on bulk purchases over 25 units. Long-term supply agreements provide availability and cost consistency while saving 5–12%.

Cost Factors Influencing Drilling Stabilizer Pricing

Material and Manufacturing Variables

Raw material costs account for 35–45% of drilling stabilizer prices. Global commodities markets affect high-grade steel pricing and product costs. Due to sophisticated processing and limited availability, non-magnetic alloys cost more. Hardfacing technique greatly affects price. Advanced ceramic matrix composites or polycrystalline diamond compact (PDC) elements may raise unit pricing by 25-40%, whereas basic tungsten carbide uses contribute nothing. Labor costs and production times depend on manufacturing complexity. Integral stabilizers need substantial machining, whereas welded blade versions provide cost benefits for some applications despite longevity problems.

Market Demand and Supply Chain Dynamics

Drilling stabilizer demand and price are closely related to oil and gas market cycles. Demand during drilling might raise prices by 10–20%. Conversely, market downturns allow for better price negotiations. Supply chain interruptions affect prices and availability. Since single-source dependency may cause pricing volatility and delivery delays, recent global events underlined the need of diverse sourcing methods.

Forex and Trade Policies

International purchases include currency exchange risks. Over normal procurement cycles, currency rates may affect project costs by 5-15%. Forward currency contracts and steady currency prices reduce these concerns. Tariffs and trade policies impact cross-border drilling equipment purchases. Current tariff rates range from 2-15% per country of origin and destination, necessitating careful total cost estimates.

Comprehensive Cost Analysis Beyond Unit Pricing

Transportation and Logistics Expenses

Shipping costs significantly impact total drilling stabilizer procurement expenses. Ocean freight typically represents 3-8% of unit value for standard shipments, while expedited air freight can add 15-25% to total costs.

FOB, CIF, and DDP pricing terms create different cost allocation structures. Understanding these terms helps buyers accurately compare supplier proposals and budget for total landed costs.

Import Duties and Regulatory Compliance

Import duties vary by country and product classification. Standard rates range from 2-12% of declared value, though trade agreements may reduce or eliminate certain tariffs. Proper product classification ensures compliance and optimal duty rates.

Quality certifications and inspection requirements add costs but provide essential quality assurance. Third-party inspection services typically cost $1,500-$5,000 per shipment but significantly reduce quality-related risks.

Hidden Costs and Additional Expenses

Warehousing and inventory carrying costs impact total ownership expenses. Proper inventory management balances availability requirements with carrying cost optimization.

Insurance coverage protects against transportation and quality risks. Comprehensive coverage typically costs 0.5-1.5% of shipment value but provides essential risk mitigation.

Strategic Procurement Approaches

Supplier Evaluation and Selection

Effective supplier evaluation extends beyond initial pricing considerations. Manufacturing capability, quality systems, delivery reliability, and technical support capabilities significantly impact long-term value.

Established manufacturers with comprehensive quality control processes deliver consistent products that reduce operational risks. WELONG's 20-year manufacturing experience and strict quality protocols exemplify the stability and reliability that drilling contractors require.

Negotiation Strategies and Timing

Market timing influences negotiation outcomes. Procurement during slower market periods often yields favorable pricing, while peak demand periods limit negotiation flexibility.

Long-term partnership approaches create mutual benefits. Suppliers offer preferential pricing and priority allocation to customers demonstrating consistent volume and reliable payment terms.

Customization and Value Engineering

OEM partnerships enable product optimization for specific applications. Custom stabilizer designs can improve drilling performance while potentially reducing costs through design optimization and material selection.

Standardization across drilling operations creates procurement efficiencies. Using common specifications and sizes enables bulk purchasing advantages and simplified inventory management.

Future Market Outlook and Pricing Trends

Technology Impact on Pricing

Advancing manufacturing technologies gradually reduce production costs while improving product quality. Automation and precision manufacturing techniques enable cost-effective production of high-quality drilling equipment.

Material science developments introduce new alloy compositions and surface treatments that enhance performance while managing cost increases. These innovations often justify premium pricing through improved operational performance and extended service life.

Market Demand Projections

Global energy demand continues driving drilling activity and equipment requirements. Emerging markets and unconventional resource development create sustained demand for drilling stabilizers and related equipment.

Renewable energy growth impacts traditional drilling equipment demand patterns. However, geothermal development and carbon capture projects create new market opportunities for specialized drilling equipment.

Economic Indicators and Price Forecasting

Inflation rates directly correlate with manufacturing cost increases. Current economic conditions suggest continued modest price increases of 3-6% annually for drilling equipment over the next several years.

Commodity price cycles influence raw material costs and final product pricing. Steel and specialty alloy price trends indicate continued volatility requiring flexible procurement strategies.

Conclusion

Understanding price, market dynamics, and supplier competencies is essential for drilling stabilizer procurement. Strategic purchasers that consider total cost of ownership rather than just purchase price might benefit from current market circumstances. Quality manufacturers like WELONG provide value via consistent quality, dependable delivery, and extensive technical support. Their oilfield equipment manufacturing knowledge, international certifications, and flexible delivery periods provide drilling companies global procurement advantages. Strategic procurement strategies that emphasize long-term supplier connections, quality assurance, and overall cost optimization outperform price-focused tactics. Understanding market dynamics helps improve current expenses and long-term operational performance.

Frequently Asked Questions

1. What factors most significantly impact drilling stabilizer pricing?

Material costs, manufacturing complexity, and market demand represent the primary pricing drivers. Premium materials like non-magnetic alloys and advanced hardfacing treatments can increase costs by 25-40%. Manufacturing volume and customization requirements also significantly influence final pricing.

2. How do Chinese drilling stabilizer prices compare globally?

Chinese manufacturers typically offer competitive pricing while maintaining international quality standards. Prices generally range 15-25% below European alternatives and 10-20% below North American suppliers, primarily due to manufacturing efficiency and established supply chains.

3. What are typical minimum order quantities for drilling stabilizers?

Standard products usually require minimum orders of 5-20 units, while custom specifications may require 10-50 units depending on complexity. Bulk discounts typically begin at 25+ units, offering 8-15% savings for qualified buyers.

4. How do shipping terms affect total drilling stabilizer costs?

Shipping can represent 3-25% of total costs depending on urgency and terms. Ocean freight (FOB) typically adds 3-8%, while expedited air freight can increase costs by 15-25%. CIF and DDP terms provide cost certainty but may include supplier margins.

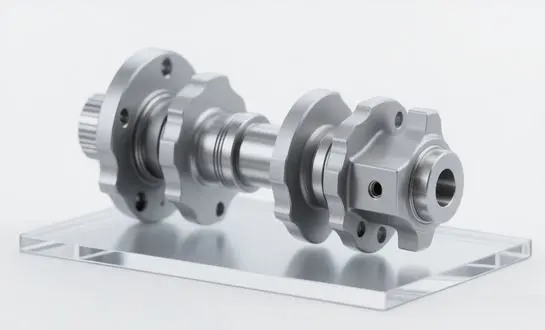

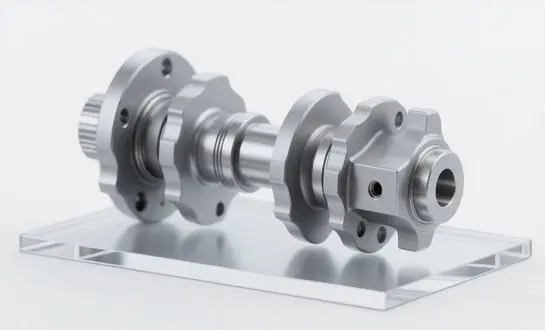

Partner with WELONG for Optimal Drilling Stabilizer Procurement

WELONG stands as your trusted drilling stabilizer supplier, combining two decades of manufacturing excellence with competitive global pricing and unmatched quality assurance. Our replaceable sleeve stabilizer systems deliver exceptional value through versatile mandrel designs that accommodate multiple hole sizes while maintaining consistent performance standards. Our commitment to quality extends beyond manufacturing through comprehensive inspection services, including in-process and final inspections with optional third-party verification. This systematic approach ensures every drilling stabilizer meets stringent API 7-1 standards and customer specifications.

Flexible shipping options including FOB, CIF, DDP, and DDU terms accommodate diverse procurement requirements, while our established relationships with international logistics providers ensure reliable delivery worldwide. Multiple transportation modes via sea, air, and rail provide options for both standard and expedited delivery requirements. Technical expertise supports your drilling operations through customized solutions and engineering consultation. Our skilled production teams maintain consistent delivery schedules while our quality control processes ensure reliable performance throughout demanding drilling applications.

Contact WELONG today at oiltools15@welongpost.com to discuss your drilling stabilizer requirements and discover how our manufacturing capabilities and global supply chain expertise can optimize your drilling equipment procurement strategy.

References

- Petroleum Equipment Institute. "Global Drilling Equipment Market Analysis and Price Trends 2023-2024." Technical Report Series, Vol. 15, 2024.

- International Association of Drilling Contractors. "Stabilizer Technology and Performance Standards for Modern Drilling Operations." IADC Technical Publication, 2023.

- Offshore Technology Research Center. "Cost Analysis of Downhole Drilling Equipment in Global Markets." Marine Engineering Quarterly, Vol. 28, No. 3, 2024.

- Society of Petroleum Engineers. "Drilling Stabilizer Design and Application Guidelines for Enhanced Performance." SPE Technical Standards, 2023.

- World Oil Equipment Manufacturers Association. "Annual Survey of Global Drilling Equipment Pricing and Market Trends." Industry Report, 2024.

- Energy Equipment Trade Association. "International Procurement Guide for Drilling Equipment and Supply Chain Management." Trade Publication Series, Vol. 12, 2023.

Share your inquiry, get the quotation accordingly!

CHINA WELONG - 20+ years manufactuer in oilfield tools