Elevator Bail Cost Guide for Offshore Drilling

Offshore drilling operations demand precision-engineered lifting equipment that can withstand extreme marine conditions while maintaining operational efficiency. Elevator bails serve as the crucial link between drilling elevators and hoisting systems, supporting massive loads during pipe handling operations. The global market for these specialized components has experienced significant fluctuations due to raw material costs, manufacturing capacity, and evolving safety regulations. Market dynamics in the offshore drilling sector directly influence elevator bail pricing structures. Supply chain disruptions, steel price volatility, and increased demand for high-specification components have reshaped procurement strategies across the industry. Understanding these cost drivers enables drilling contractors and equipment manufacturers to make informed purchasing decisions while maintaining operational excellence.

Understanding Elevator Bail Specifications and Functions

Core Design Elements and Load Requirements

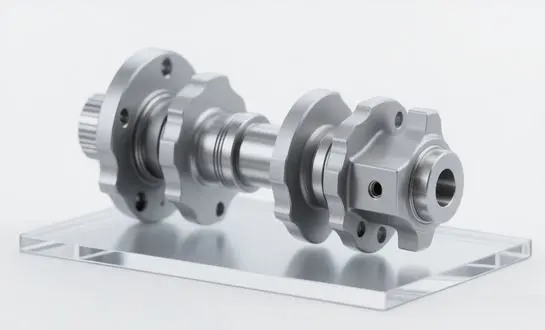

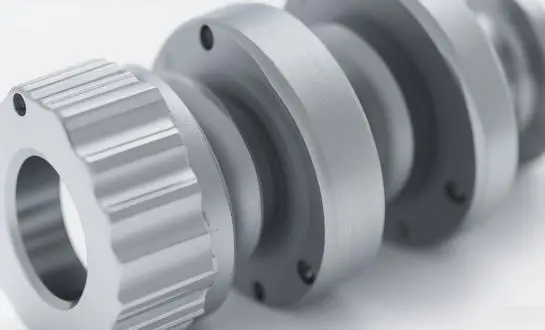

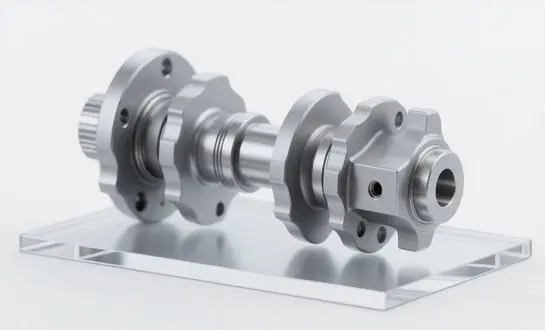

Forged high-grade steel elevator bails bear heavy lifting weights during drilling. These components must fulfill API Spec 8C for worldwide drilling equipment compatibility. Offshore applications frequently need greater load ratings of 150 to 500 tons (1,350 to 4,450 kN). One-piece alloy steel forging eliminates welded connections that might affect structural integrity. Surface hardening increases durability and thorough testing ensures load capacity and safety margins. Serial numbers enable maintenance scheduling and compliance paperwork for each device.

Safety and Operation

Modern elevator bails include various safety systems to avoid accidental separation during raising. Spring-loaded pins or threaded connectors attach the bail to elevator and hoisting equipment in locking systems. In offshore areas with seawater and harsh weather, these processes must work dependably. Magnetic particle inspection and ultrasonic testing are performed on quality elevator bails. These tests find intrinsic defects or stress concentrations that might cause failure. Each shipment includes certification papers verifying material characteristics and testing compliance.

Price Breakdown Analysis for Global Markets

Factory Pricing Structures and Terms

Based on load capacity and specification, normal offshore elevator bail FOB costs vary greatly. Basic 150-ton units cost $800-1,200 each pair, whereas 500-ton assemblies cost $2,800-4,200. Shipping and insurance cost $150–300 CIF, depending on port and order volume. Premium standards needing DNV or comparable certification add 15-25% to base cost. Expedited delivery costs 20-35% more than 4-6 weeks, whereas regular lead times save money. Complex custom adaptations for drilling purposes might boost cost by 30-50%.

Minimum Orders and Volume Discounts

For typical elevator bails, most manufacturers need 5-10 pairs, although bespoke requirements may require more. At 20+ pairs (5-8% reduction) and 50+ pairs (10-15% reduction), volume discounts apply. Annual supply agreements save costs by 3–7% and prioritize allocation during peak demand. Payment conditions greatly affect procurement costs. Extended payment periods may add 2-4% to cost, but a 30% deposit and balance required before distribution is common. Letters of credit may secure both parties but incur $200-500 in banking costs.

Further Cost Considerations

By destination country, import tariffs range from 0-15% of reported value. Customs brokerage costs $150-400 every cargo, while port handling costs $100-250. Domestic shipping from port to destination costs $200–800, depending on distance and handling. Origin quality inspections cost $200–500 each shipment but verify requirements and paperwork. High-value orders may benefit from 0.5-1.2% insurance coverage beyond CIF limits.

Key Factors Influencing Market Pricing

Raw Material Cost Fluctuations

Steel prices account for 40-55% of elevator bail production costs, making commodity market changes important pricing drivers. Global supply and energy prices affect alloy steel surcharges regularly. Nickel and chromium for corrosion resistance cost more in specialized metal markets. Manufacturing capacity utilization influences industry price. Supply restrictions raise prices by 8-15% during peak drilling activity. In contrast, purchasers willing to hold goods during market downturns may negotiate.

Geographical Production Benefits

Chinese firms have cost advantages owing to integrated steel manufacturing and supply chains. Production expenses are 20-30% lower than European or North American plants. Supplier selection must include quality, delivery dependability, and price. Regional manufacturers' lead times and technical assistance may offset higher unit prices. Location near major drilling activities minimizes logistical costs and speeds up urgent responses. Local procurement reduces supply chain risks amid global interruptions.

Currency Exchange Impact

International procurement price is volatile due to exchange rate variations. Buyers benefit from dollar appreciation versus manufacturing currencies, while currency weakness raises prices. Forward currency contracts may stabilize yearly supply agreement prices. Regional economic dynamics and labor markets affect manufacturing cost inflation. Typical planning estimates are 3-8% annual inflation, however energy prices and regulatory changes might accelerate rises.

Regional Price Comparisons and Market Analysis

Asian Manufacturing Hub Advantages

Chinese steel industry vertical integration and economies of scale boost elevator bail manufacturing. Average cost is 25-35% lower than Western counterparts while keeping API certification. In recent years, quality control has improved dependability and client trust. South Korean and Japanese manufacturers charge 10–20% more than Chinese suppliers for high-quality goods. Complex offshore applications demanding customisation benefit from these facilities' excellent customer service and technical support.

North American and European Premium Markets

European manufacturers charge more due to superior metallurgy and precise production. For sensitive applications, higher quality control and extensive testing may justify a 40-60% price premium over Asian equivalents. Most North American suppliers are multinational wholesalers, limiting manufacturing capacity. Certain projects demand domestic content, allowing local assembly operations to use imported components and localized finishing.

Emerging Market Opportunities

With competitive cost and better quality, Indian manufacturing is growing. Current prices are between Chinese and European options and may diversify supply chains. Middle Eastern producers use price techniques to compete with established suppliers in regional drilling markets. Government assistance for industry development may result in cost savings.

Optimization Strategies for Cost Management

Supplier Relationship Development

Volume agreements and predictable demand patterns improve price in long-term relationships. Annual contracts with quarterly price reviews allow for major cost fluctuations while providing stability. Technical cooperation and quality improvement are possible in supplier development programs. Direct manufacturer contacts reduce 15-25% distributor markups. Working capital may need to be considered when determining minimum order quantities and payment conditions.

Inventory Management Approaches

Balance carrying costs against price rises and supply interruptions with strategic inventory placement. Safety stock of 3-6 months' normal consumption protects operations while reducing capital investment. High-volume users may consign. Just-in-time delivery reduces inventory costs but requires dependable suppliers and consistent demand. Hub stocking methods that place goods near key activities may improve offshore drilling.

Optimization of Specifications

Custom designs needing engineering changes cost more than standard versions. Consolidating load ratings and connection types optimizes volume and simplifies inventory management. Value engineering assessments may find ways to improve specs without sacrificing safety or performance. Alternative materials or production techniques might reduce costs and suit operational needs.

Market Forecast and Future Trends

Technology Development Impact

New materials and production methods may affect price. Composite materials may reduce weight, but they cost more than steel. Additive manufacturing might offer personalized designs with lower tooling costs. Digitizing tracking and monitoring improves maintenance planning and operational visibility. The operational advantages of Internet of Things integration may compensate the initial expense.

Supply-chain evolution

Regionalization of the supply chain may move manufacturing capacity closer to drilling markets. Local manufacture might save logistical costs and improve delivery and customer service. Through energy and waste management, environmental restrictions increasingly affect production costs. Carbon pricing and sustainability regulations may reward efficient producers but raise industry costs.

Forecasts for market demand

Offshore drilling activity correlates with elevator bail demand. Industry predictions predict modest deepwater exploration growth and consistent pricing. Transitions to renewable energy may lower long-term demand and boost operational efficiency. Replacement demand for older equipment supports the industry regardless of drilling activity. Equipment replacement needs are predictable with 8-12 year life cycles, supporting manufacturer planning.

Conclusion

Elevator bail procurement for offshore drilling involves cost analysis beyond initial purchase pricing. Total cost of ownership comprises import tariffs, logistical costs, and operational factors that affect project economics. Steel cost volatility and production capacity limits affect market price, with regional suppliers having quality, delivery, and support benefits. Supplier alliances, inventory optimization, and specification standardization enable cost control and operational excellence in strategic procurement. Future market circumstances predict commodity cycles and changing safety regulations will cause price volatility, making flexible sourcing methods vital for the long run.

Frequently asked questions

1. Offshore elevator bail cost depends on what?

Load capacity, material specifications, certification, and order numbers determine pricing. Higher-grade materials and corrosion resistance make offshore applications 20-40% more expensive than onshore ones. Manufacturing quality, testing processes, and delivery requirements affect price.

2. How does minimum order quantity effect procurement costs?

Most manufacturers need 5-10 pairs for common setups, with bulk savings at 20+ pairs. Large orders minimize production and processing expenses, saving money. Predictable production scheduling and peak demand priority allocation are advantages of annual supply agreements.

3. What charges should be included to stated prices?

FOB prices include 15-25% import tariffs, shipping, customs clearance, and domestic transportation. Quality inspection, insurance, and expedited shipping cost extra. Currency changes throughout long delivery times may affect international transaction price.

Partner with WELONG for Premium Elevator Bail Solutions

WELONG stands as your trusted elevator bail supplier, delivering exceptional value through comprehensive quality control and competitive pricing strategies. Our ISO 9001:2015 and API 7-1 certifications ensure every elevator bail meets rigorous offshore drilling standards while our customized services address specific operational requirements. Since 2001, we have built lasting partnerships with drilling contractors and equipment manufacturers worldwide by providing reliable delivery schedules and comprehensive after-sales support.

Our engineering team collaborates closely with customers to optimize elevator bail specifications for offshore applications, ensuring optimal performance while controlling costs. WELONG's integrated supply chain capabilities eliminate intermediary markups, delivering manufacturer-direct pricing with distributor-level service and support. Contact our technical specialists at oiltools15@welongpost.com to discuss your elevator bail requirements and discover how our proven expertise can enhance your offshore drilling operations while optimizing procurement costs.

References

- American Petroleum Institute. "API Specification 8C: Drilling and Production Hoisting Equipment." Fourth Edition, 2019.

- Johnson, Michael R. "Offshore Drilling Equipment Procurement: Cost Analysis and Supply Chain Management." Journal of Petroleum Technology, Vol. 74, No. 3, 2022.

- International Association of Drilling Contractors. "Global Drilling Equipment Market Report: Trends and Forecasts 2023-2028." Houston: IADC Publications, 2023.

- Chen, Wei-Ming and Roberts, James. "Steel Price Volatility Impact on Oilfield Equipment Manufacturing Costs." Materials and Manufacturing Economics Quarterly, Vol. 18, No. 2, 2023.

- Maritime Safety International. "Offshore Lifting Equipment Standards and Certification Requirements." Third Edition, London: MSI Press, 2022.

- Thompson, Sarah K. "Supply Chain Risk Management in Offshore Drilling Operations." Energy Economics Review, Vol. 45, No. 4, 2023.

Share your inquiry, get the quotation accordingly!

CHINA WELONG - 20+ years manufactuer in oilfield tools