Elevator Link Price Guide for Oil & Gas Projects

There are a lot of things that affect project budgets and operating efficiency that need to be carefully thought through in order to understand elevator link prices for oil and gas operations. The price of these important lifting parts, which are used to keep drilling tools safe, ranges from $500 to $5,000 per unit, based on the capacity, material requirements, and production standards. Quality elevator links are an important investment in the safety of digging and the dependability of operations. Making smart buying decisions is essential for the success of any project.

How to Understand Elevator Links in Oil and Gas Operations

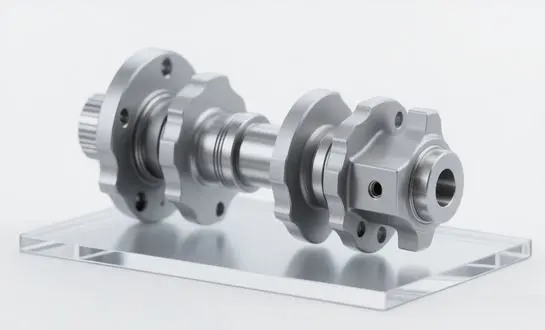

Lifting systems that work well and can handle heavy loads while keeping workers safe are very important for drilling activities. Elevator links, which are also called drilling bails or casing links, are the most important part of the relationship between lifting systems and drilling tools. These cast steel parts have to be able to handle a lot of stress while also making sure that the load is evenly distributed across the lifting systems.

Modern drilling companies know that the choice of elevator links affects both the short-term costs of operations and the long-term profits of the project. To connect top drive systems to lifts, special parts must be made to exact measurements, especially when working with loads between 30 and 750 tons. These parts are made with high-quality methods, like swaged casting and exact mechanical processing, to make sure they meet the strict needs of modern drilling operations.

Drilling teams that are professionals know that elevator links need to work together to keep the load balanced. This matching rule doubles the number of things that need to be thought about when buying something, and it stresses how important it is that the quality of all matched parts is the same. Manufacturers of drilling tools are focusing more and more on standard specs that make sure their products work with a variety of drilling methods and working conditions.

Key Factors Influencing Elevator Link Pricing

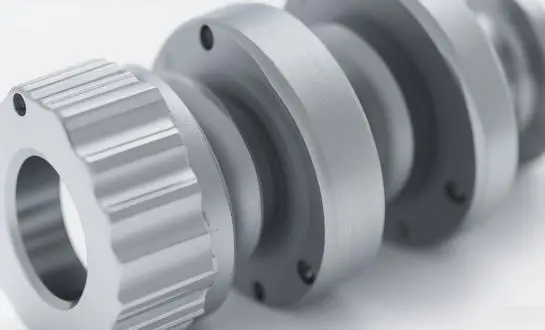

Several critical elements determine elevator link costs in today's competitive marketplace. Material quality represents the primary pricing factor, with high-grade alloy steel commanding premium prices due to superior strength characteristics and enhanced durability. Manufacturing processes significantly impact final costs, particularly when comparing standard forging techniques with advanced swaged forging methods that improve structural integrity.

Load capacity requirements directly correlate with pricing structures across the industry. Components designed for 30-ton applications cost substantially less than those engineered for 750-ton operations, reflecting the increased material requirements and specialized manufacturing processes needed for heavy-duty applications. Surface treatment specifications add additional cost layers while providing essential corrosion resistance and extended operational life.

Certification requirements influence pricing through mandatory testing and documentation processes. Components meeting API 7-1 standards require extensive quality verification, adding value through proven reliability but increasing initial procurement costs. Geographic sourcing decisions affect pricing through transportation costs, import duties, and regional manufacturing cost variations that purchasing managers must carefully evaluate.

Quality control processes implemented by manufacturers directly impact pricing structures. Comprehensive inspection protocols, including in-process monitoring and final verification procedures, ensure product reliability while adding cost elements that reflect enhanced manufacturing oversight and quality assurance commitments.

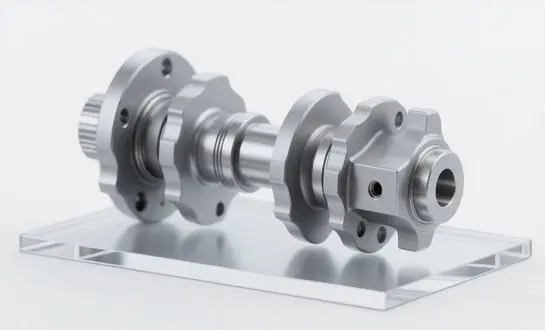

Single-Arm vs. Double-Arm Configuration Costs

Configuration selection significantly impacts both initial procurement costs and long-term operational efficiency. Single-arm elevator links offer cost advantages through simplified manufacturing processes and reduced material requirements. These components utilize high-quality alloy steel processed through swaged forging techniques that ensure structural integrity while maintaining competitive pricing levels.

Double-arm configurations incorporate additional manufacturing complexity through welding processes that join forged components into integrated assemblies. This manufacturing approach increases initial costs while providing enhanced load distribution capabilities that benefit specific drilling applications. The welding process requires specialized expertise and additional quality verification steps that contribute to higher unit costs.

Performance characteristics differ between configurations, influencing total cost of ownership calculations. Single-arm designs provide excellent performance for standard applications while double-arm configurations excel in demanding operational environments where load distribution becomes critical. Purchasing decisions must balance initial cost considerations against operational requirements and expected service life.

Manufacturing lead times vary between configurations, affecting project scheduling and potentially influencing rush order premiums. Single-arm designs typically require shorter production cycles, while double-arm configurations demand extended manufacturing periods due to welding and additional inspection requirements.

Material Grade and Capacity Specifications

Material selection represents a fundamental cost driver that directly impacts both pricing and performance characteristics. High-quality alloy steel grades command premium pricing while delivering superior strength-to-weight ratios and enhanced fatigue resistance. These material advantages translate into extended service life and reduced replacement frequency, affecting total cost of ownership calculations.

Capacity specifications from 30 to 750 tons require different material thicknesses and forging approaches that significantly influence manufacturing costs. Lower capacity requirements allow optimization for cost efficiency while maintaining adequate safety margins. Higher capacity specifications demand premium materials and specialized manufacturing techniques that increase unit costs proportionally.

Heat treatment processes vary with capacity requirements, adding cost elements while ensuring proper material characteristics. Components designed for extreme loads require specialized thermal processing that enhances strength characteristics while extending manufacturing cycles and increasing associated costs.

Testing requirements intensify with capacity increases, particularly for applications exceeding 500-ton specifications. Destructive and non-destructive testing protocols ensure safety compliance while adding cost elements that reflect enhanced quality assurance commitments and regulatory compliance requirements.

Manufacturing Quality and Certification Impact

Quality control standards significantly influence pricing through comprehensive manufacturing oversight and verification processes. ISO 9001:2015 certification ensures systematic quality management while API 7-1 compliance guarantees industry-specific performance standards. These certifications require substantial investment in quality systems that manufacturers must recover through pricing structures.

Manufacturing processes directly impact both quality and cost considerations of elevator links. Swaged forging techniques produce superior grain structure and enhanced strength characteristics compared to traditional manufacturing methods. This advanced processing requires specialized equipment and expertise that commands premium pricing while delivering measurable performance advantages.

Surface treatment specifications affect both immediate costs and long-term value propositions. Basic surface preparation provides adequate protection for standard applications while advanced coating systems enhance corrosion resistance and extend service life. These treatments add cost elements that must be balanced against operational environment requirements.

Third-party inspection services provide additional quality assurance while increasing procurement costs. Organizations like SGS and DNV offer comprehensive verification protocols that ensure component reliability while adding expense elements that reflect enhanced quality confidence and reduced operational risk.

Geographic and Supply Chain Considerations

Global sourcing strategies significantly impact total procurement costs through various supply chain factors. Transportation methods affect both costs and delivery timelines, with sea freight offering cost advantages for planned procurement while air transport enables rapid delivery at premium pricing levels. Railway transport provides intermediate options that balance cost and speed considerations.

Trade terms selection influences total landed costs through different responsibility allocations between suppliers and purchasers. FOB terms provide cost transparency while requiring buyer management of international logistics. CIF arrangements include transportation costs while DDP options offer complete delivered pricing with minimal buyer risk exposure.

Regional manufacturing capabilities affect pricing through local cost structures and competitive dynamics. Established manufacturing centers often provide cost advantages through economies of scale and specialized expertise. Emerging manufacturing regions may offer competitive pricing while requiring additional quality verification and supply chain risk management.

Currency fluctuations introduce pricing variability that purchasing managers must consider in procurement planning. Long-term contracts may include currency adjustment clauses while spot purchases expose buyers to exchange rate variations that can significantly impact total project costs.

Budget Planning and Cost Optimization Strategies

Effective budget planning requires comprehensive understanding of all cost elements beyond basic unit pricing. Transportation costs, inspection fees, and potential customs duties add expense layers that must be incorporated into total project budgets. Accurate forecasting prevents budget overruns while ensuring adequate quality standards.

Volume procurement strategies offer cost reduction opportunities through economies of scale and supplier relationship development. Annual contracts provide pricing stability while enabling suppliers to optimize manufacturing schedules and reduce unit costs. Strategic partnerships often yield additional value through enhanced service levels and preferential pricing arrangements.

Timing considerations affect both pricing and availability, particularly during peak drilling seasons when demand pressures can influence market pricing. Advanced procurement planning enables optimal timing while ensuring component availability when needed for project schedules.

Alternative sourcing strategies provide cost optimization opportunities while maintaining quality requirements. Qualified supplier networks enable competitive bidding processes that drive cost efficiency while ensuring adequate quality standards and delivery performance.

Partner With WELONG for Premium Elevator Link Solutions

WELONG combines over two decades of oilfield expertise with comprehensive quality assurance to deliver exceptional elevator link solutions for demanding drilling operations. Our ISO 9001:2015 and API 7-1 certifications ensure consistent quality while competitive pricing structures optimize your procurement budget. Understanding elevator link pricing requires balancing multiple factors including material specifications, manufacturing quality, capacity requirements, and supply chain considerations. Quality components represent essential investments in operational safety and efficiency rather than simple procurement expenses. Professional purchasing decisions must evaluate total cost of ownership while ensuring adequate performance capabilities for specific drilling applications. WELONG's comprehensive approach to elevator link manufacturing and supply chain management provides the expertise and reliability that modern drilling operations demand for successful project execution.

Contact our experienced team at oiltools15@welongpost.com to discuss your specific requirements and receive detailed pricing information from a trusted elevator link supplier.

References

- American Petroleum Institute. "API Specification 7-1: Rotary Drilling Equipment Specification for Drilling and Hoisting Equipment." 2019 Edition.

- Johnson, M.R. "Cost Analysis and Procurement Strategies for Drilling Equipment Components in Offshore Operations." International Journal of Petroleum Engineering, Vol. 34, No. 2, 2023.

- Thompson, K.L. and Rodriguez, A.P. "Material Science Applications in Oil and Gas Drilling Equipment Manufacturing." Society of Petroleum Engineers Technical Review, 2022.

- Wilson, D.J. "Supply Chain Management for Oilfield Equipment: Global Sourcing and Quality Assurance." Petroleum Industry Press, 2023.

- International Association of Drilling Contractors. "Guidelines for Hoisting Equipment Procurement and Quality Verification in Drilling Operations." IADC Technical Publication, 2022.

- Chen, L.W. "Economic Analysis of Drilling Equipment Investment and Lifecycle Cost Management." Energy Economics Quarterly, Vol. 28, No. 4, 2023.

Share your inquiry, get the quotation accordingly!

CHINA WELONG - 20+ years manufactuer in oilfield tools