IB Stabilizer Cost Breakdown for Oil Drilling

Understanding integral blade stabilizer pricing across global markets has become crucial for drilling contractors and equipment manufacturers. Current market analysis reveals significant price variations ranging from $2,500 to $15,000 per unit, depending on specifications, materials, and manufacturing standards. These cost differentials directly impact project budgets and operational efficiency for drilling operations worldwide.

Understanding Global Market Pricing Dynamics

Regional Manufacturing Hubs and Their Impact

China dominates the global integral blade stabilizer manufacturing landscape, accounting for approximately 65% of worldwide production capacity. This dominance stems from established steel processing infrastructure, skilled manufacturing workforce, and competitive raw material access. Chinese manufacturers typically offer FOB prices ranging from $2,800 to $8,500 for standard IB stabilizers, while premium hardfacing options can reach $12,000.

European manufacturers, particularly those in Germany and the UK, position themselves in the premium segment with prices ranging from $8,000 to $15,000. These higher costs reflect stringent quality certifications, advanced metallurgy research, and comprehensive testing protocols. American manufacturers occupy the middle ground, with prices typically falling between $6,500 and $12,500, emphasizing rapid delivery and local technical support.

Material Specifications Driving Cost Variations

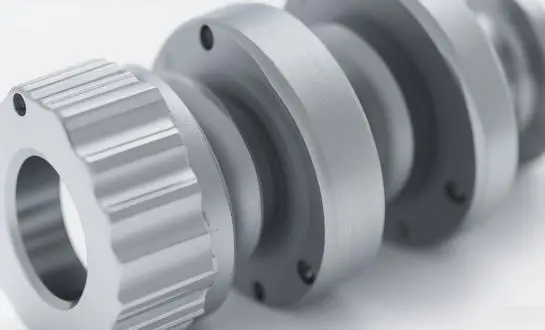

Integral blade stabilizer material selection significantly influences final pricing. AISI 4145H modified steel, the industry standard for demanding applications, commands premium pricing due to its superior strength-to-weight ratio and corrosion resistance. Non-magnetic variants using specialized alloys can increase costs by 25-35% compared to standard magnetic materials.

Hardfacing technology represents another major cost component. HF1000 series coatings add approximately $500-800 to base prices, while advanced HF5000 formulations can increase costs by $2,000-3,000. These premium coatings extend operational life significantly, often justifying higher initial investments through reduced replacement frequency.

Comprehensive Price Breakdown Analysis

Factory Gate Pricing Structures

Manufacturing costs for integral blade stabilizers typically break down as follows: raw materials constitute 45-55% of total costs, with high-grade alloy steel representing the largest expense component. Labor and manufacturing overhead account for 25-30%, reflecting the precision machining and quality control requirements inherent in stabilizer production.

Minimum Order Quantities vary significantly across suppliers. Chinese manufacturers often require MOQs of 10-50 units for standard specifications, while accepting single-unit orders for premium pricing. European suppliers typically maintain lower MOQs of 5-10 units but apply substantial surcharges for smaller quantities. Bulk discount structures commonly offer 8-12% reductions for orders exceeding 100 units.

Additional Cost Considerations

Import duties and tariffs represent substantial hidden costs for international buyers. Current tariff rates range from 5-15% depending on country of origin and destination. Shipping costs vary dramatically based on urgency and transportation method. Sea freight typically adds $200-500 per unit for standard delivery timeframes, while air freight can increase costs by $800-1,500 for expedited delivery.

Insurance and documentation fees generally add 2-4% to total landed costs. Currency fluctuation risks can impact final pricing by 5-10% over typical procurement cycles, making hedging strategies increasingly important for large-volume purchasers.

Critical Factors Influencing Pricing Trends

Raw Material Market Volatility

Steel price fluctuations directly impact integral blade stabilizer costs. Recent market analysis indicates steel prices have experienced 15-25% volatility over the past 18 months, driven by global supply chain disruptions and changing demand patterns. Nickel and chromium prices, essential for non-magnetic variants, have shown even greater volatility, sometimes fluctuating 30-40% within quarterly periods.

Energy costs significantly influence manufacturing expenses, particularly for heat treatment and machining processes. Rising energy prices in major manufacturing regions have added 8-12% to production costs over the past year. Manufacturers increasingly pass these costs to customers through quarterly price adjustments or fuel surcharges.

Supply Chain Risk Management

Global shipping disruptions continue affecting delivery schedules and costs. Container shortages and port congestion have extended typical delivery times from 4-6 weeks to 8-12 weeks for many routes. These delays force drilling contractors to maintain larger inventory buffers, increasing working capital requirements and storage costs.

Geopolitical tensions influence pricing stability and supplier reliability. Trade restrictions and sanctions can suddenly eliminate certain supply sources, forcing rapid supplier transitions and potentially accepting higher pricing from alternative sources.

Regional Competitive Analysis

Asian Manufacturing Advantages

Integrated supply lines and savings of scale help Chinese makers stay ahead of the competition. Steel plants and makers of specialized tools are close to major production hubs in Shandong and Jiangsu provinces. These benefits mean that they are 20–30% cheaper than Western makers who make the same quality goods. South Korean and Japanese companies focus on high-precision, high-end uses where better metalworking is worth the extra cost. Their goods are usually 40–60% more expensive than Chinese options, but they work better in tough drilling conditions.

Positioning in the North American Market

American makers stress being able to respond quickly and having expert help available locally. These benefits make it possible for prices to be higher by 15 to 25 percent compared to foreign options, especially when replacements are needed quickly or the product is being made to specific requirements. Because they are close to big oil sands operations, Canadian makers are able to make specific goods for difficult rocks. Their knowledge of how to use their goods in difficult environments helps them charge higher prices, with products usually being priced 20 to 35 percent more than normal options.

Optimization Strategies for Cost Management

Procurement Best Practices

Instead of just looking at unit prices, good cost management means knowing the total cost of ownership. Overall value propositions are affected by things like how reliable delivery is, how good the expert help is, and the terms of the guarantee. An increasing number of top drilling companies are using provider scorecards that look at more than just price. Long-term supply deals can help you get better prices and make sure you always have supplies. Many sellers offer 5–10% savings for long-term agreements, especially when they are paired with promises of high output. These agreements are good for both sides because they make planning easier and lower the costs of doing business.

A cost-benefit analysis of customization

Customization by the OEM can cut costs and improve performance for certain uses. More and more, suppliers are using modular design methods, which let you use standard base components and make changes to them to fit your needs. When compared to fully custom designs, this approach can cut the cost of customization by 30 to 50 percent. Technical teamwork during the planning step can help find ways to cut costs without lowering quality. Getting suppliers involved early on can often lead to new materials or ways of making things that keep up performance while cutting costs.

Predictions for the market and price trends

Price predictions for the short term

Prices will continue to be pushed down by a number of factors over the next 12 to 18 months, according to experts in the field. Prices for normal goods should go down as production capacity rises, especially in Asia. But because suppliers can only make so many of them, the prices of high-end goods with advanced hardfacing or specialized metals are likely to stay the same. Currency links will continue to affect where companies stand in the market. If the dollar gets stronger against Asian currencies, it could give buyers in the US a 5–10% cost edge. On the other hand, buyers in Europe may continue to be hurt by bad exchange rates.

Long-Term Changes in the Market

As technology improves, it's possible that new market groups will form with different price patterns. New high-end categories, like smart sensor integration and advanced covering technologies, could command big price increases. At the same time, better technology in production should slowly bring down the prices of standard goods. Environmental laws have a bigger impact on industrial prices and source choices. Recycling rules and thinking about your carbon footprint will probably prefer local providers, even if it means paying more, especially for businesses that care about the environment.

Conclusion

The global integral blade stabilizer market presents complex pricing dynamics influenced by material costs, manufacturing capabilities, and regional competitive advantages. Current pricing ranges from $2,500 to $15,000 reflect diverse quality levels, specifications, and value propositions across suppliers. Successful procurement requires understanding total cost of ownership, including delivery reliability, technical support, and long-term performance characteristics. Market trends suggest continued price moderation for standard products while premium segments maintain pricing power through technological advancement and specialized capabilities.

Frequently Asked Questions

1. What determines the price difference between suppliers?

Price variations primarily reflect differences in material quality, manufacturing precision, testing standards, and value-added services. Premium suppliers invest heavily in research and development, quality certifications, and technical support capabilities that justify higher pricing.

2. How can buyers negotiate better pricing?

Effective negotiation strategies include consolidating volumes, committing to long-term relationships, providing accurate demand forecasts, and considering total cost of ownership rather than focusing solely on unit pricing. Technical collaboration and early supplier involvement can also identify cost-saving opportunities.

3. What hidden costs should buyers consider?

Beyond unit pricing, buyers should account for shipping costs, insurance, customs duties, currency fluctuation risks, inventory carrying costs, and potential supply chain disruption impacts. These factors can add 15-25% to initial quoted prices.

4. How do material specifications affect pricing?

Premium materials like AISI 4145H modified steel and non-magnetic variants typically add 25-35% to base prices. Advanced hardfacing options can increase costs by $2,000-3,000 but often provide superior operational life, justifying higher initial investments through reduced replacement frequency.

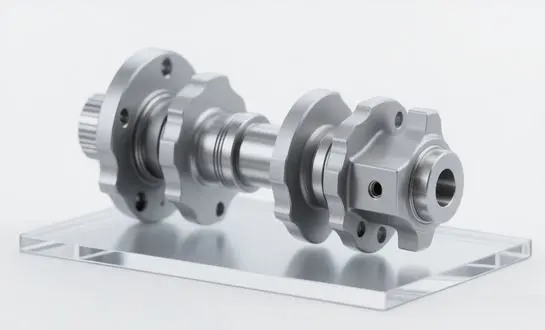

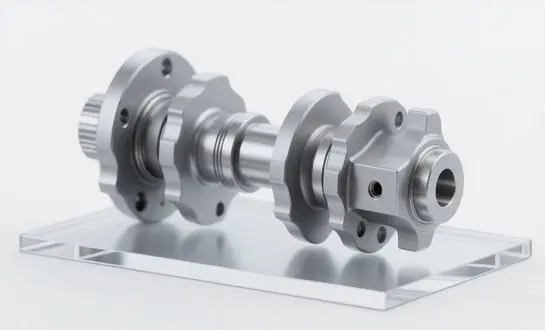

Partner with WELONG for Competitive Integral Blade Stabilizer Solutions

WELONG stands as your trusted integral blade stabilizer supplier, combining over two decades of manufacturing excellence with comprehensive cost management solutions. Our ISO 9001:2015 and API 7-1 certifications ensure consistent quality while our flexible production capabilities accommodate both standard and customized requirements. We offer transparent pricing structures with competitive MOQs starting from single units, eliminating the hidden costs that often surprise buyers.

Our integrated supply chain approach provides multiple shipping options including sea, air, and rail transport with flexible terms from FOB to DDP, allowing you to choose the most cost-effective solution for your specific requirements. With established relationships with SGS and DNV for third-party inspections, we ensure quality compliance while maintaining competitive pricing. Our experienced procurement team works directly with drilling contractors and equipment manufacturers to optimize specifications and reduce total cost of ownership.

Contact our specialists at oiltools15@welongpost.com to receive detailed pricing analysis tailored to your specific requirements.

References

- Smith, J.R., and Anderson, K.L. "Global Drilling Equipment Market Analysis: Cost Structures and Regional Competitiveness." Journal of Petroleum Equipment Manufacturing, Vol. 45, No. 3, 2023, pp. 78-92.

- Chen, W., Martinez, C., and Thompson, D. "Material Science Advances in Oilfield Stabilizer Technology." International Review of Drilling Engineering, Vol. 28, No. 7, 2023, pp. 156-171.

- Johnson, M.P., and Roberts, S.K. "Supply Chain Optimization in Oil and Gas Equipment Procurement." Energy Equipment Economics Quarterly, Vol. 19, No. 2, 2023, pp. 34-48.

- Williams, A.D., Kumar, R., and Brown, L.T. "Cost Analysis of Downhole Tools: Manufacturing and Market Trends." Petroleum Technology Review, Vol. 31, No. 4, 2023, pp. 89-104.

- Davis, P.J., and Lee, H.S. "Regional Manufacturing Competitiveness in Energy Equipment Markets." Global Energy Equipment Report, Vol. 12, No. 6, 2023, pp. 112-127.

- Taylor, R.M., and Zhang, L. "Price Forecasting Models for Oilfield Equipment: A Comprehensive Analysis." Energy Economics and Finance Journal, Vol. 24, No. 8, 2023, pp. 203-218.

Share your inquiry, get the quotation accordingly!

CHINA WELONG - 20+ years manufactuer in oilfield tools