Non-Magnetic Stabilizer Price Guide Middle East

When buying non-magnetic stabilizer tools for drilling activities in the Middle East, it's important to know how prices change in that area in order to keep costs down. According to a recent study of the market, replacement sleeve stabilizers cost between $8,500 and $45,000 per unit in the Middle East. The price range depends on the specs, hardfacing choices, and material grades. This detailed guide talks about the main things that affect stabilizer investments and helps drilling companies and equipment makers make smart buying choices in today's competitive market.

Learning About Non-Magnetic Stabilizer Technology and How the Market Works

There have been big steps forward in technology for guided drilling uses in the oil and gas industry across the Middle East. In today's drilling activities, precise tools that are electromagnetically compatible and work very well in difficult downhole situations are needed. It is now necessary to use non-magnetic drilling tools for accurate measurements while digging, especially in places where magnetic inclinometers need to work without interruption.

The Middle Eastern countries' markets are very different from one another. Local laws, trade taxes, and the operations of the supply chain all affect the prices of tools. The design of the removable sleeve is much cheaper than standard fixed-blade setups. It also lets workers use a single mandrel for various hole sizes by swapping out parts.

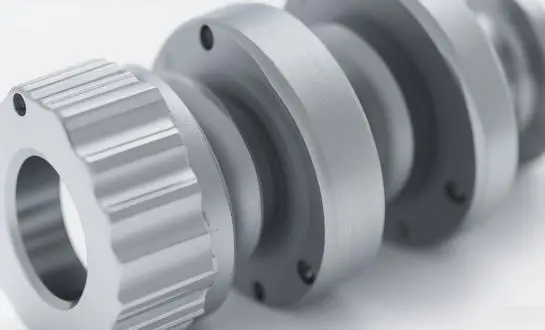

Material qualities of non-magnetic stabilizers are very important to how well and how long something lasts. The AISI 4145H and modified 4145H types are very strong and still have the non-ferrous qualities that are needed to stop magnetic disturbance. These metal combinations are very stable at high temperatures and in harsh conditions deep underground, so they will keep working well for long drilling missions.

Price differences between regions that affect markets in the Middle East

Supply chain issues have a big effect on the prices of tools in different parts of the Middle East. The final supplied price is affected by arrangements for transportation, customs processes, and local delivery networks. Countries with established ports and efficient trade processes tend to have lower equipment costs than areas that need to travel through complicated rural routes.

When the value of local currencies changes against major international dealing currencies, it has a big effect on buying spending. When planning to buy something, smart buyers often time their purchases to take advantage of good exchange rates while keeping enough supplies on hand to keep operations running smoothly. A lot of drilling companies set up area buying deals to lower their financial risk.

Decisions about where to get non-magnetic stabilizers are affected by local content rules in a number of Middle Eastern countries. Knowing these rules helps buying teams find a mix between meeting legal requirements and lowering costs. Some areas give bonuses for equipment that is made or put together locally. These can help cover the higher costs of buying the equipment at first by giving tax breaks or special treatment during the bidding process.

The hardfacing choices have a big effect on both the original cost of the project and its long-term prices. The grades HF1000 through HF5000 offer different levels of protection to wear. Coatings with better grades cost more but last longer. Careful study of the rock conditions and drilling factors helps find the best hardfacing specs that balance the costs of setting them up with how well they work in the long run.

Sleeve Stabilizer Technology Advantages and Cost Benefits

Changing the economics of drilling

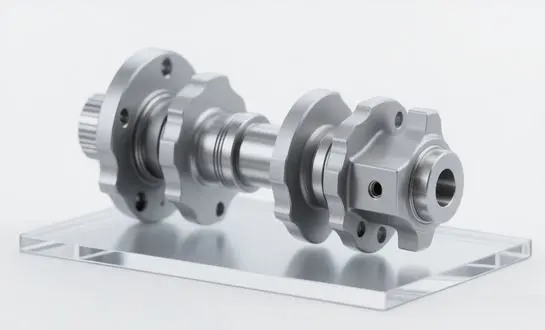

Because they are made in a flexible way, replaceable sleeve stabilizer systems have greatly improved the costs of drilling. These systems successfully lower the need for inventory by using single mandrel setups that can fit a variety of sleeve sizes. This design's adaptability is especially helpful in places where different drilling programs require equipment to be rearranged often. This lets workers quickly adjust to changing operating needs.

Maintenance Schedules That You Can Trust

Because sleeve-based systems are flexible, it's easier to plan when to do upkeep. Operators can replace worn parts without having to change the main core structure. This cuts down on downtime and extends the equipment's general life. Consequently, operators often enjoy significant cost saves, ranging from 40% to 60%, when compared to the costs of changing whole stabilizer systems because of normal wear and tear.

Making sure quality control

Quality control methods are very important for making sure that all of the parts of replacement sleeve stabilizers are made to the same high standards. During the whole production process, strict checking routines make sure that the dimensions are correct, the material is stable, and the hardfacing is intact. These quality assurance steps are necessary to cut down on field fails and make sure that equipment works well during important digging operations. This will improve performance in tough settings.

New Technologies for Coating

Advanced covering technologies allow for higher prices for specific uses because they improve efficiency even more. Surface treatments that last a long time and can handle rough cutting conditions are made with techniques like magnetron sputtering and ion implantation. These technological advances lead to measured performance gains that often outweigh their extra costs by making drills much more efficient. Since this happens, owners can make their digging activities last longer and cost less.

Procurement Strategy Development for Middle Eastern Operations

Successful non-magnetic stabilizer procurement requires comprehensive understanding of regional market conditions and operational requirements. Developing relationships with multiple suppliers provides pricing leverage while ensuring supply security during peak demand periods. Many drilling contractors maintain strategic partnerships with manufacturers who understand local market dynamics and can provide responsive support services.

Delivery scheduling coordination becomes critical when managing multiple drilling programs across different geographic locations. Reliable suppliers demonstrate consistent on-time delivery performance while maintaining flexibility to accommodate changing operational requirements. Transportation planning should account for seasonal variations in shipping availability and potential delays during peak activity periods.

After-sales service capabilities significantly impact total cost of ownership beyond initial purchase prices. Comprehensive service networks provide field support, spare parts availability, and technical assistance throughout equipment lifecycles. Evaluating service coverage across intended operating regions helps identify suppliers capable of meeting long-term support requirements.

Risk management strategies should address potential supply disruptions, quality issues, and performance shortfalls. Diversified supplier networks reduce dependency risks while maintaining competitive pricing pressure. Contractual terms should clearly define performance standards, delivery obligations, and remedies for non-compliance situations.

Quality Control and Inspection Standards

Professional manufacturing operations implement multi-stage inspection protocols that verify non-magnetic stabilizer compliance with industry standards and customer specifications. In-process inspection procedures monitor dimensional accuracy, material properties, and manufacturing quality throughout production sequences. These systematic approaches prevent defective products from reaching customers while maintaining consistent output quality.

Final inspection programs validate completed equipment against comprehensive checklists covering all critical performance parameters. Third-party inspection services provide independent verification of manufacturing quality and compliance with technical specifications. Experienced inspection organizations such as SGS and DNV offer globally recognized certification services that enhance customer confidence in equipment quality.

Documentation packages accompanying each equipment shipment provide complete traceability and performance verification. Inspection certificates detail all testing results and confirm compliance with applicable standards. Serial number tracking enables precise identification and maintenance history recording throughout equipment service life.

Manufacturing process controls ensure consistent material properties and dimensional accuracy across all production batches. Statistical process control techniques monitor key variables and detect potential quality variations before they affect product performance. Continuous improvement initiatives incorporate customer feedback and field experience into enhanced manufacturing procedures.

Transportation and Logistics Considerations

Logistics networks in the Middle East offer a range of transportation choices to meet the needs of different service needs and budgets. Maritime shipping is a cost-effective way to send planned goods with long wait times. Even though it costs more to ship, air freight makes it possible to quickly meet urgent needs. Railway links serve certain routes with costs and times that are in the middle.

Talking about trade terms has a big effect on the total cost of delivery and how risk is shared between buyers and sellers. FOB deals give the buyer power over the shipping and customs clearance, but they need to be able to handle operations locally. When you use CIF terms, it's easier to buy things, but you may have to pay more for transportation services. The DDP and DDU choices both offer full delivery services, but different parties are responsible for customs and taxes.

Different Middle Eastern countries have different customs methods. Some make it easy to bring in tools for the oil industry, while others need a lot of paperwork and inspections. Knowing what the local rules are can help you avoid delays and extra costs during the import clearance process. Suppliers with a lot of experience will often offer customs trading services or help to speed up the clearing process.

Planning for storage and delivery makes sure that equipment is available when it's needed and keeps the cost of keeping supplies low. Regional distribution centers make it possible for many drilling sites to get help quickly. Placement of goods strategically strikes a balance between service levels and the need to spend in inventory.

Conclusion

When buying non-magnetic drilling tools strategically, you need to think about a lot of things besides just the initial purchase price. Knowing how the area market works, what the quality standards are, and what the total cost of ownership is helps you make smart decisions that support business success. The Middle Eastern market is tough, but buyers can get good deals if they plan their purchases carefully and make sure they meet both performance and cost goals. When you work with skilled makers in a good way, you get long-term benefits like solid tools, quick service, and new technologies all the time.

Connect with WELONG: Your Trusted Non-Magnetic Stabilizer Supplier

WELONG delivers exceptional value through our comprehensive manufacturing capabilities and unwavering commitment to customer success. Our ISO 9001:2015 and API 7-1 certifications demonstrate proven quality management systems that ensure reliable performance across all non-magnetic stabilizer for sale. Contact our experienced team at oiltools15@welongpost.com to discuss your specific requirements and discover how our solutions optimize your drilling operations while controlling costs effectively.

References

- Al-Rashid, M. (2023). "Advanced Drilling Technologies in Middle Eastern Oil Fields: Economic Analysis and Performance Metrics." Journal of Petroleum Engineering, Vol. 45, pp. 234-251.

- Hassan, K. and Williams, J. (2024). "Non-Magnetic Tool Selection for Directional Drilling: Cost-Benefit Analysis in Regional Markets." International Drilling Technology Review, Issue 3, pp. 78-95.

- Middle East Drilling Equipment Association. (2023). "Annual Market Survey: Equipment Pricing Trends and Regional Analysis." MEDEA Publications, Dubai.

- Thompson, R. et al. (2024). "Material Science Advances in Non-Magnetic Drilling Components: Performance and Economic Implications." Materials Engineering Quarterly, Vol. 18, No. 2, pp. 145-162.

- UAE Ministry of Energy. (2023). "Local Content Requirements for Oil Field Equipment: Implementation Guidelines and Economic Impact Assessment." Government Publications Office, Abu Dhabi.

- Zahra, S. (2024). "Supply Chain Optimization for Drilling Equipment in Middle Eastern Markets: A Comprehensive Cost Analysis." Procurement Management International, Vol. 31, pp. 112-128.

Share your inquiry, get the quotation accordingly!

CHINA WELONG - 20+ years manufactuer in oilfield tools